Market Update - April 2025

It’s officially selling season in real estate!

There’s no denying that sunshine helps sell homes—just compare the turnout at an open house on a rainy day to one on a bright, sunny afternoon. Inventory is slowly increasing, though it remains about 20% lower than pre-2020 levels.

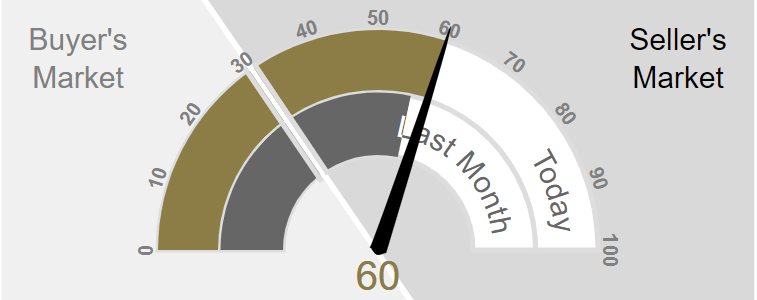

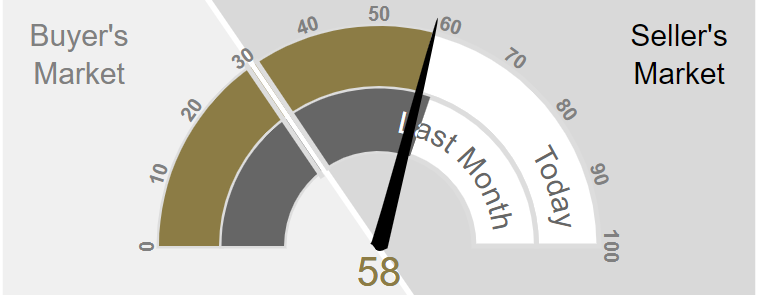

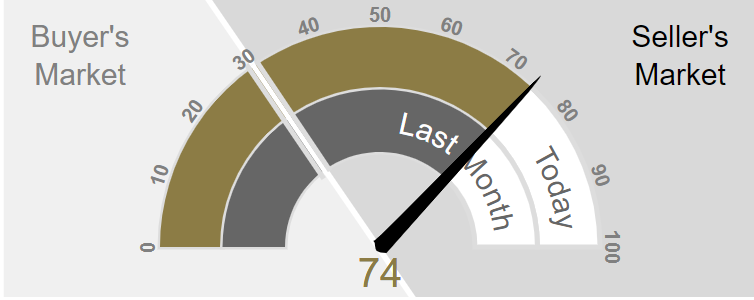

Market Action Index - April 2025

Confidence — A fleeting feeling

It’s officially selling season in real estate!

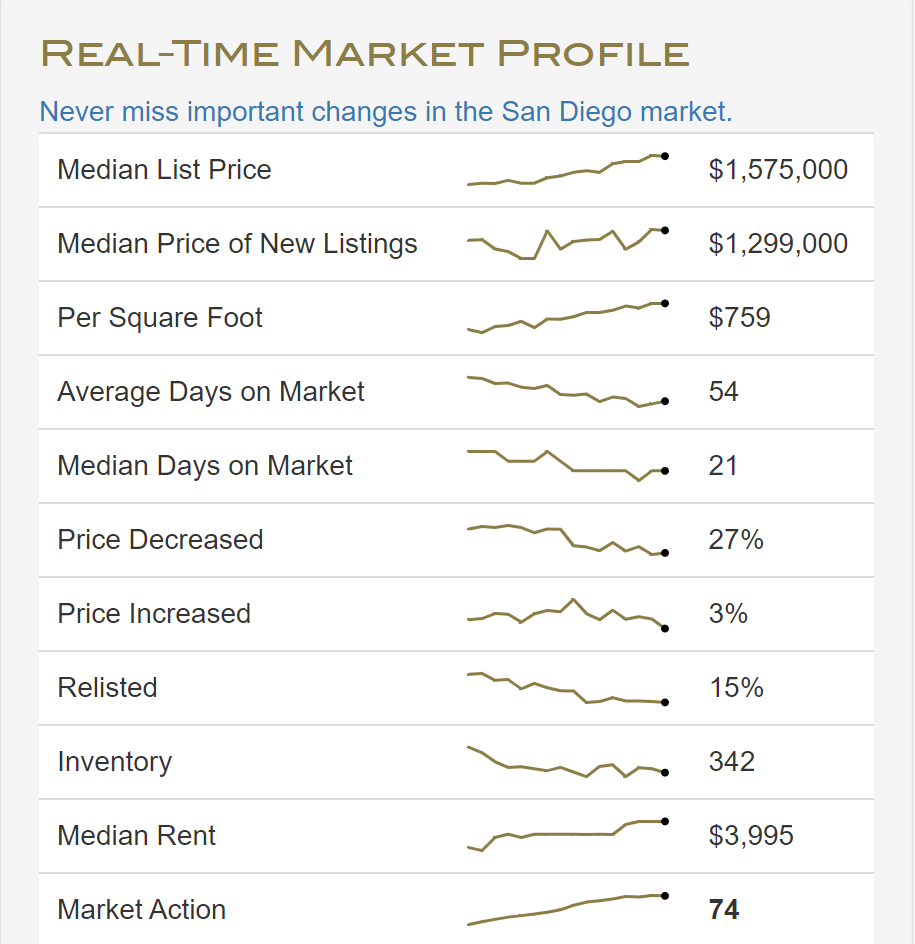

There’s no denying that sunshine helps sell homes—just compare the turnout at an open house on a rainy day to one on a bright, sunny afternoon. Inventory is slowly increasing, though it remains about 20% lower than pre-2020 levels. Home prices have ticked up slightly over the past month. The single-family home market remains solidly in seller’s territory, while attached properties are beginning to edge closer to a buyer’s market—something we haven’t seen in quite some time.

The major factors shaping the market right now continue to be inflation, affordability, and elevated interest rates. That said, mortgage rates have recently dropped to their lowest levels since November of last year, which has suddenly made homeownership possible again for millions who wouldn’t have qualified just a week ago. However, qualification doesn’t always translate to action. Many buyers are holding off, citing global uncertainty, inflationary pressure on everyday goods, and a softening economy. Confidence is critical when making one of life’s biggest financial decisions, and right now, that confidence is still rebuilding.

I believe that even a modest stretch—just 3 to 4 months—of sub-6% rates could be the catalyst needed to unlock a significant amount of inventory, particularly from the Boomer generation who have been waiting for the right time to list.

If you’re thinking about buying, selling, or just want to talk strategy, I’m always happy to connect. Let’s chat!

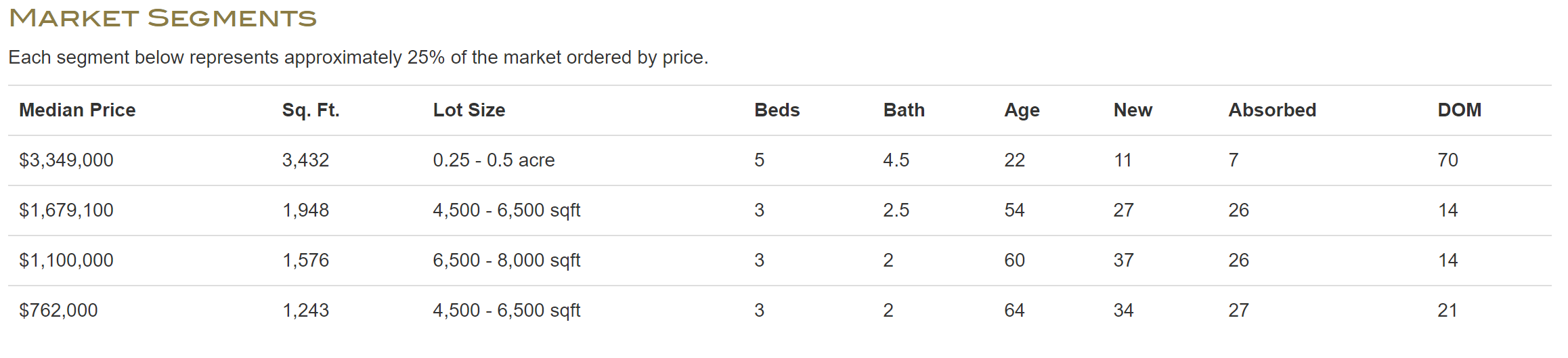

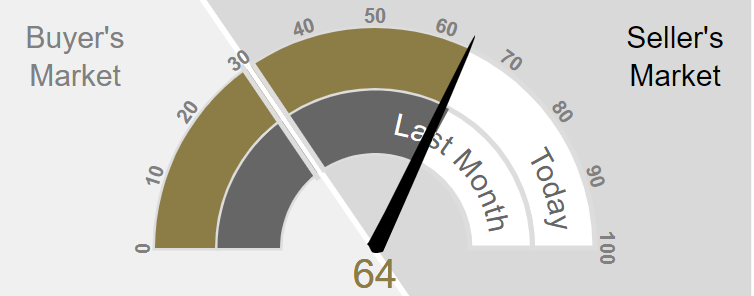

Market Segments - April 2025

“However, qualification doesn’t always translate to action. Many buyers are holding off, citing global uncertainty, inflationary pressure on everyday goods, and a softening economy. Confidence is critical when making one of life’s biggest financial decisions, and right now, that confidence is still rebuilding.”

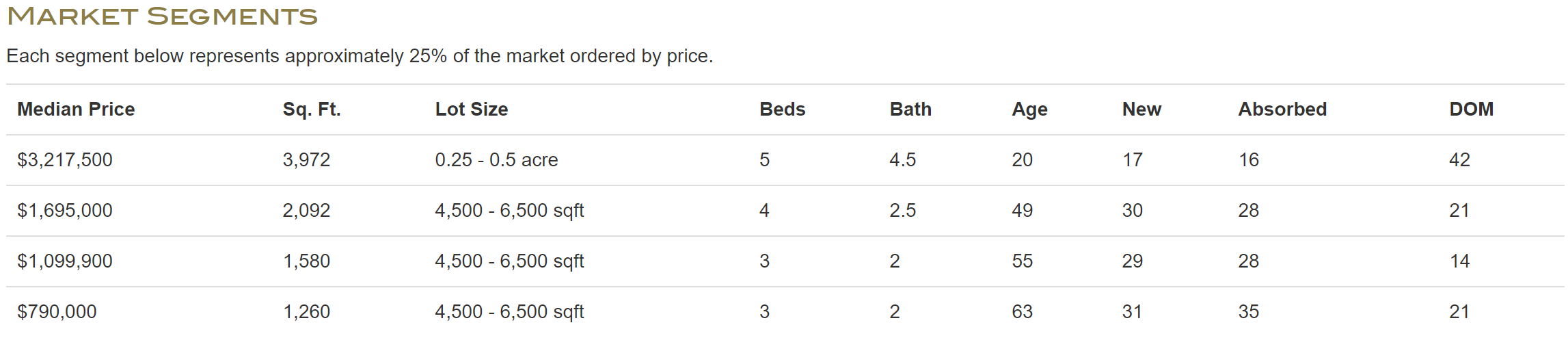

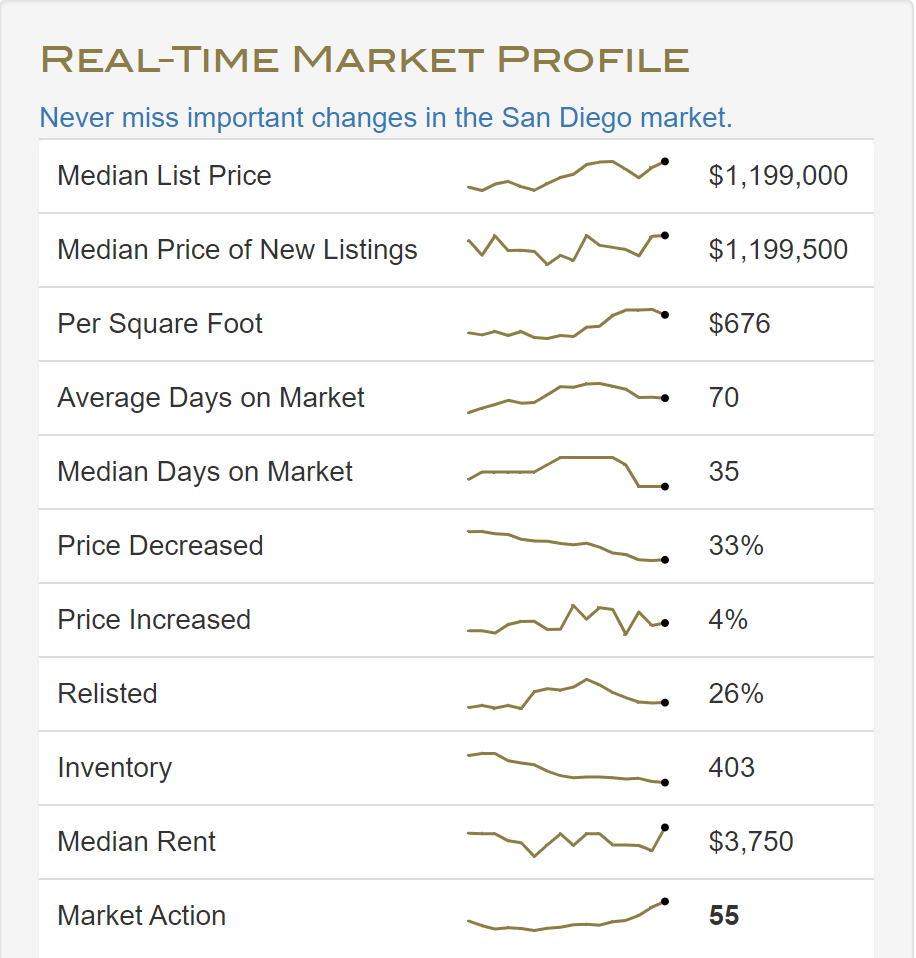

Market Profile - April 2025

HOT TOPICS

Would you like a home valuation and neighborhood report every month?

Those receiving these have really enjoyed them! If you’d like a free home report every month, all I need is your address and an email for you. It’s a great way to track home values, loan information, and know exactly what’s being bought and sold in your area Send me an email brendan.gail@kw.com to be added!

Retail sales rebound but remain sluggish

Retail sales in the U.S. increased slightly in February, rising just 0.2%—less than the 0.6% economists expected. Weak spending at gas stations, auto sales, and restaurants held growth back, but a strong job market and wage increases could keep spending steady in March.

3. Inflation slows down in February

Consumer prices rose 2.8% from last year, showing a slight slowdown after months of increases. While lower gas and food prices helped ease inflation, costs for hospital care, insurance, and airfare remained high, which could push up future inflation reports.

4. Small business optimism declines amid uncertainty

Confidence among small business owners fell in February, with concerns about tariffs and government layoffs weighing on sentiment. While optimism remains above historical averages, continued trade tensions could make businesses even more cautious in the coming months.

5. Consumer sentiment hits a 28-month low

Americans are feeling more uncertain about the economy, with consumer confidence dropping sharply in March. Rising inflation expectations and worries about tariffs driving up prices have contributed to the decline, making it harder for the Federal Reserve to consider interest rate cuts.

6. Foreclosures increase but remain low

Foreclosure filings in the U.S. rose 5% in February but are still far below levels seen during the 2008 housing crisis. With home prices expected to rise in 2025 and no signs of a major recession, foreclosure activity should remain stable.

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!

Market Update - March 2025

Time is flying—it’s hard to believe we’re heading into the second quarter of 2025 and the peak spring and summer housing market!

Here’s the reality: If you’re thinking about buying, now is the time to get in the game. There’s real opportunity, especially if you’re open to tackling a project or two…

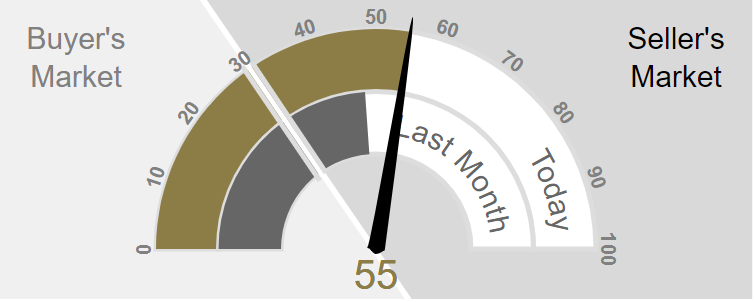

Market Action Index - March 2025

Q1 is Almost in the Books!

Time is flying—it’s hard to believe we’re heading into the second quarter of 2025 and the peak spring and summer housing market!

Here’s the reality: If you’re thinking about buying, now is the time to get in the game. There’s real opportunity, especially if you’re open to tackling a project or two. Sellers, on the other hand, need to be realistic—homes that aren’t priced right or properly prepared are sitting longer than usual. Even with slightly lower interest rates, affordability remains a major challenge for buyers.

If a move is on your mind, let’s connect soon. The market is already heating up, and I want to make sure you’re ahead of the curve!

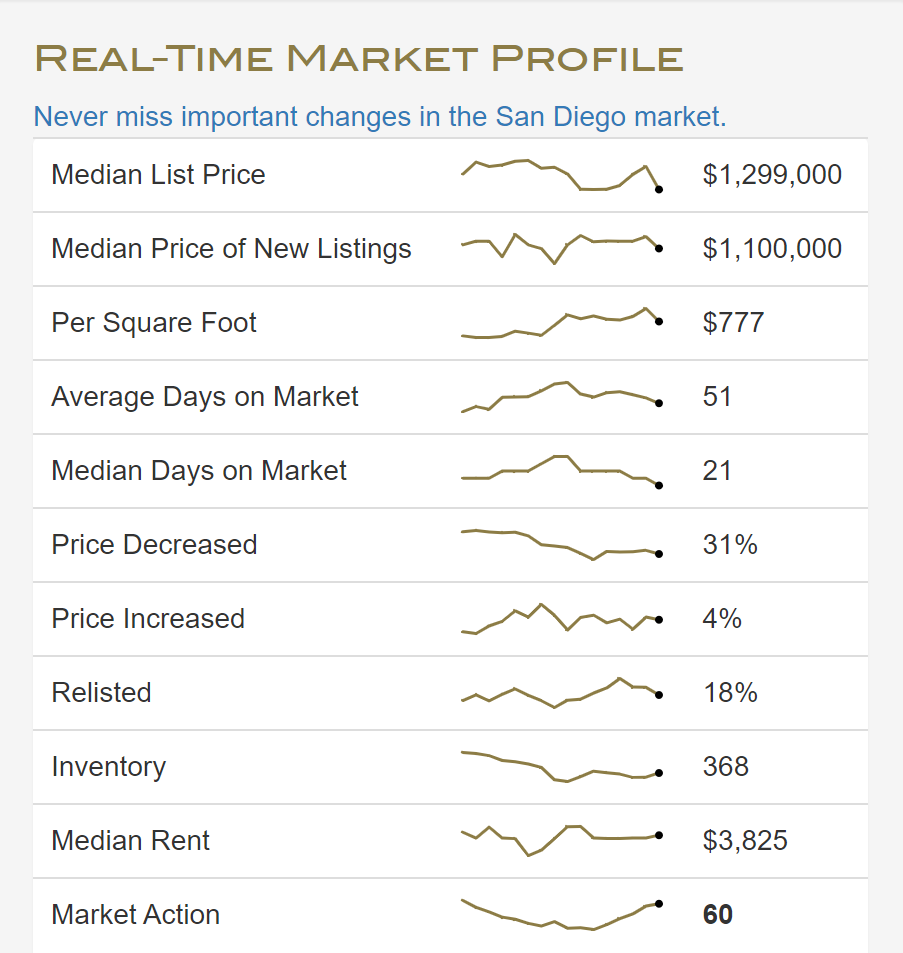

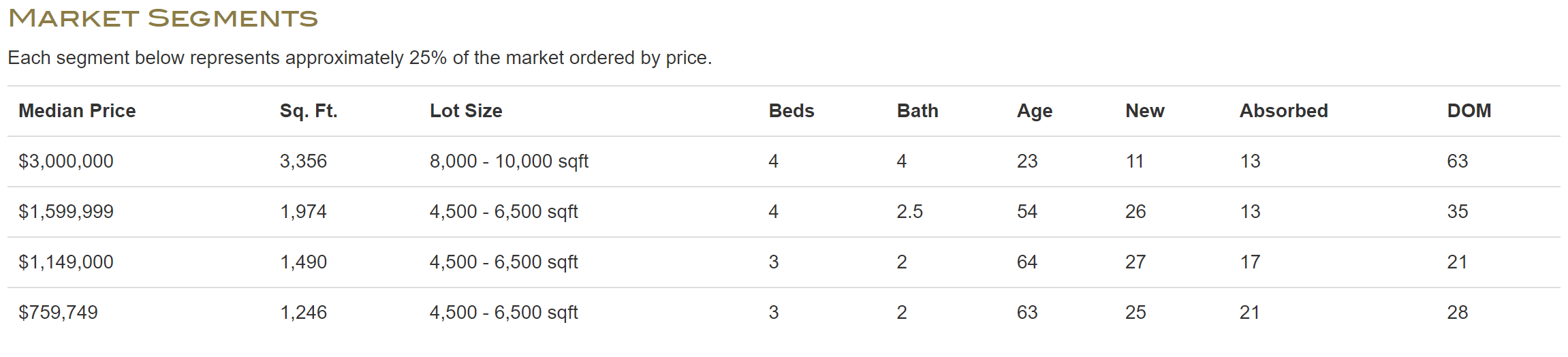

Market Segments - March 2025

“Qualifying income for 1st Time Home Buyers to purchase a median home in San Diego is $167,100”

Market Profile - March 2025

HOT TOPICS

Would you like a home valuation and neighborhood report every month?

Those receiving these have really enjoyed them! If you’d like a free home report every month, all I need is your address and an email for you. It’s a great way to track home values, loan information, and know exactly what’s being bought and sold in your area Send me an email brendan.gail@kw.com to be added!

Retail sales rebound but remain sluggish

Retail sales in the U.S. increased slightly in February, rising just 0.2%—less than the 0.6% economists expected. Weak spending at gas stations, auto sales, and restaurants held growth back, but a strong job market and wage increases could keep spending steady in March.

3. Inflation slows down in February

Consumer prices rose 2.8% from last year, showing a slight slowdown after months of increases. While lower gas and food prices helped ease inflation, costs for hospital care, insurance, and airfare remained high, which could push up future inflation reports.

4. Small business optimism declines amid uncertainty

Confidence among small business owners fell in February, with concerns about tariffs and government layoffs weighing on sentiment. While optimism remains above historical averages, continued trade tensions could make businesses even more cautious in the coming months.

5. Consumer sentiment hits a 28-month low

Americans are feeling more uncertain about the economy, with consumer confidence dropping sharply in March. Rising inflation expectations and worries about tariffs driving up prices have contributed to the decline, making it harder for the Federal Reserve to consider interest rate cuts.

6. Foreclosures increase but remain low

Foreclosure filings in the U.S. rose 5% in February but are still far below levels seen during the 2008 housing crisis. With home prices expected to rise in 2025 and no signs of a major recession, foreclosure activity should remain stable.

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!

Market Update - February 2025

Did the season start early? After a few cold days and some rain, it certainly feels like spring—both outside and in the housing market. Inventory is higher than it’s been in the last five years, yet still below pre-2020 levels. The real shift? Homes are selling 28% faster over the past few weeks. The best 20% of homes—well-priced, well-prepared—are still going into escrow within the first couple of weeks, while everything else lingers much longer.

Market Action Index - February 2025

Is Spring Already Here?

Did the season start early? After a few cold days and some rain, it certainly feels like spring—both outside and in the housing market. Inventory is higher than it’s been in the last five years, yet still below pre-2020 levels. The real shift? Homes are selling 28% faster over the past few weeks. The best 20% of homes—well-priced, well-prepared—are still going into escrow within the first couple of weeks, while everything else lingers much longer.

Here’s what that means for you:

✔ Buyers: There’s opportunity out there.

✔ Sellers: Preparation is key. The days of listing a home “as-is” and expecting multiple offers in five days are gone. Price and presentation matter more than ever.

If you’re thinking about making a move, let’s talk ASAP. It’s already been a busy season, and I want to make you a priority before the market heats up even more.

Market Segments - February 2025

“Across California, median days on market was 67 days as of December 2024.”

Market Profile - February 2025

HOT TOPICS

Would you like a home valuation and neighborhood report every month? Those receiving these have really enjoyed them! If you’d like a free home report every month, all I need is your address and an email for you. It’s a great way to track home values, loan information, and know exactly what’s being bought and sold in your area Send me an email brendan.gail@kw.com to be added!

Housing Affordability at Near Record Low – High mortgage rates and home prices have made it harder to afford a home, with only 15% of households able to purchase a median-priced home in Q4 2024. Affordability is expected to remain a challenge in 2025 as mortgage rates stay elevated.

Slight Housing Sentiment Improvement, But Affordability Worries Persist – Consumer confidence in homebuying and selling conditions improved slightly in January, but most expect home prices, rents, and mortgage rates to rise in 2025. Optimism about lower mortgage rates dropped significantly.

Mortgage Rates Ease After January Peak – Rates had been declining after hitting an 8-month high but remain elevated due to inflation concerns and stronger-than-expected wage growth. The Fed is holding off on rate cuts until further economic progress is seen.

Consumer Confidence Drops Amid Economic Uncertainty – Confidence fell in January, especially among younger and higher-income households, due to concerns about inflation, interest rates, and job prospects. Despite this, optimism about personal finances and the stock market remains.

Job Growth Slows, But Labor Market Stays Strong – The U.S. added 143,000 jobs in January, below expectations, but the unemployment rate dipped to 4%. Strong wage growth may delay Fed rate cuts, but future decisions will depend on economic conditions.

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!

Market Update - January 2025

It’s still a great time to buy as the market shakes off the holiday lull. It’s also the perfect time to start preparing to list a home for sale. I’m currently working on bringing homes to market in Poway, Fallbrook, and Rancho Bernardo (55+).

Market Action Index - January 2025

Happy New Year!

Can you believe we’re already halfway through the first month of the year? Time flies! Activity is picking up, and I’ve got several exciting opportunities in the works. Despite some economic headwinds, I’m confident we’ll see momentum build as we move closer to spring.

It’s still a great time to buy as the market shakes off the holiday lull. It’s also the perfect time to start preparing to list a home for sale. I’m currently working on bringing homes to market in Poway, Fallbrook, and Rancho Bernardo (55+).

If you’re interested in learning more about these properties or discussing your real estate goals, feel free to reach out! Let’s make this year a successful one together.

Market Segments - January 2025

“The NAR predicts that mortgage rates will stabilize near 6%.”

Market Profile - January 2025

HOT TOPICS

Would you like a home valuation and neighborhood report every month? Those receiving these have really enjoyed them! If you’d like a free home report every month, all I need is your address and an email for you. It’s a great way to track home values, loan information, and know exactly what’s being bought and sold in your area Send me an email brendan.gail@kw.com to be added!

Devastating Wildfires in Southern California -

The recent (and ongoing) wildfires in LA County have destroyed nearly 10,000 properties, forcing 180,000 people to evacuate. Housing activity in affected areas will stall temporarily, but demand is expected to recover during the spring season. With a tightened housing supply, rents and home prices in surrounding areas could increase, while rebuilding efforts may boost economic activity by late 2025. However, the wildfires may exacerbate the insurance crisis, potentially driving up homeowner costs.

December Housing Sentiment -

The Fannie Mae Home Purchase Sentiment Index dropped slightly in December to 73.1, though it remains higher than a year ago. Consumer optimism about mortgage rates persists, with 42% expecting lower rates in the next 12 months, despite recent increases following the jobs report. Rising rates and affordability concerns may continue to impact sentiment in the coming months.

Job Growth Exceeds Expectations -

Nonfarm payrolls grew by 256,000 in December, far exceeding the 155,000 forecast. Gains were led by health care, leisure, hospitality, and government sectors, while manufacturing saw a slight decline. The unemployment rate improved to 4.1%, and wages rose 3.9% year-over-year. This unexpected labor market strength likely delays any immediate rate cuts by the Fed.

Mortgage Rates Increase After Jobs Report -

Stronger-than-expected job growth in December pushed mortgage rates higher, with the 30-year fixed rate climbing to 7.26%. Bond yields rose alongside expectations that the Federal Reserve may delay rate cuts in upcoming meetings. Further fluctuations in mortgage rates are anticipated with the release of the Consumer Price Index.

Consumer Expectations on Inflation and Job Turnover -

Consumers’ short-term inflation expectations held steady at 3.0% in December, while medium-term expectations rose slightly. Expected home price growth also increased marginally to 3.1% for the next year. Job market sentiment weakened, with job turnover expectations falling and fewer consumers confident about finding new employment if needed—the lowest level since April 2021

Home projects this spring?? Need a guy (or girl) for that? I probably know someone…

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!

Market Update - December 2024

What a week it’s been! Plenty of questions, and many still need answers. Here’s what we know: the Fed just cut rates by 25 basis points, yet mortgage rates went up. Markets rallied around President Trump’s re-election, which has temporarily impacted mortgage rates negatively.

Market Action Index - December 2024

The market conditions remain similar to last month—slow. Many people seem drained from the election season, and the holidays add to everyone’s busy schedules. The biggest challenge remains affordability, a topic we've discussed extensively. As long as interest rates hold steady and job reports show positive growth, we’re likely to see this sluggish market persist.

The economy's resilience continues to face headwinds, but predictions for home prices in 2024 vary widely, that home prices could rise anywhere from 1.5% to 10%….depending on the source. Which is my humble opinion, is no opinion at all. We could probably safely say that every year here in San Diego. Are you a buyer and want to take advantage of a sluggish market?…we need to talk before the year ends…we need to get the wheels moving to make something happen in Q1.

Market Segments - December 2024

“According to a recent survey on homeowners’ insurance, the percentage of individuals experiencing difficulties in obtaining coverage has doubled over the past year, rising from 16% to 31%.”

Market Profile - December 2024

HOT TOPICS

Would you like a home valuation and neighborhood report every month? Those receiving these have really enjoyed them! If you’d like a free home report every month, all I need is your address and an email for you. It’s a great way to track home values, loan information, and know exactly what’s being bought and sold in your area Send me an email brendan.gail@kw.com to be added!

Service Sector Slowdown with Rising Prices:

The ISM services index showed a slowdown in November, with key components like employment and new orders declining. However, prices paid rose due to wage growth, complicating the Federal Reserve's goal of cooling inflation without hurting growth. Tariff concerns are adding uncertainty, particularly in electronics and hospital supplies.Residential Construction Boosts Spending:

Construction spending rose 0.4% in October, driven by a 1.5% increase in residential outlays, mainly from home improvement projects. Multifamily spending stayed flat, while nonresidential spending fell due to high interest rates and tight credit. Data center construction stood out, showing strong growth.Consumer Sentiment Mixed:

Consumer confidence hit a nine-month high in December, with optimism about current conditions boosted by the holiday season. However, future sentiment dropped to a six-month low as inflation and economic uncertainty persisted. Expectations of higher prices, partly due to potential tariffs, weighed on consumers.

Labor Market Recovery Supports Rate Cut:

November saw a rebound in payrolls with 227,000 jobs added after October’s disruptions. Wage growth exceeded expectations, but the unemployment rate rose slightly to 4.2%, giving the Federal Reserve reason to consider a rate cut in December.Affordability and Relocation Trends:

Affordability is the second biggest reason people relocate, following proximity to family. The South is the most popular destination due to better home values and favorable tax policies. Remote work and outdoor spaces are key priorities for movers, with job proximity less of a factor for many.

Hope you have a wonderful Christmas and Holiday season!

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!

Market Update - November 2024

What a week it’s been! Plenty of questions, and many still need answers. Here’s what we know: the Fed just cut rates by 25 basis points, yet mortgage rates went up. Markets rallied around President Trump’s re-election, which has temporarily impacted mortgage rates negatively.

Market Action Index - November 2024

What a week it’s been! Plenty of questions, and many still need answers. Here’s what we know: the Fed just cut rates by 25 basis points, yet mortgage rates went up. Markets rallied around President Trump’s re-election, which has temporarily impacted mortgage rates negatively. I expect we’ll see rates slowly decline as we move through 2025.

We’re closer to a buyer’s market than we’ve been in over four years, with homes now sitting on the market for over a month—even those in good condition. Affordability remains a challenge, though there’s good news: more inventory means more options, even as prices climb at a steadier pace. Realistic relief will likely require further inflation decreases and weaker jobs reports.

Considering buying during the holiday season? It might be a smart move with options available! Reach out with any questions.

Market Segments - November 2024

“Homes located within a mile of a Starbucks coffee shop tend to appreciate at a faster rate than homes that are farther away. This phenomenon, known as the ‘Starbucks Effect’, highlights the importance of local amenities in driving demand and property values in certain neighborhoods.”

Market Profile - November 2024

HOT TOPICS

Would you like a home valuation and neighborhood report every month? Those receiving these have really enjoyed them! If you’d like a free home report every month, all I need is your address and an email for you. It’s a great way to track home values, loan information, and know exactly what’s being bought and sold in your area Send me an email brendan.gail@kw.com to be added!

Fed Cuts Rates: The Fed cut interest rates by 0.25% in November as expected. Even with a strong labor market and inflation close to target, more cuts are likely—one as soon as December. Since the announcement, mortgage rates have dipped slightly, helped by market calm post-election.

3. Housing Sentiment Up: Fannie Mae's housing sentiment hit a high since early 2022, with more people feeling it’s a good time to buy. Optimism is fueled by a stronger job market and hope that rates will ease next year, though recent rate increases are still a challenge.

4. Better Housing Affordability: Affordability in California improved in Q3 with lower home prices and easing interest rates, though recent rate hikes may keep affordability tight in the near term.

5. NAR’s Growth Forecast: The National Association of REALTORS® predicts strong home sales growth in 2025 and 2026 as rates stabilize. With anticipated rate cuts and solid job growth, existing home sales could see big gains, while new home sales might rise by 11% in 2025.

6. Construction Spending Up: Construction spending rose again in September, with single-family homes leading the growth. Multifamily projects dipped slightly but may rebound soon with increasing demand.se, potentially boosting mortgage activity in the upcoming week.

Things are STABLIZING AND GETTING READY TO ROLL IN 2025. If moving is in your future. Let’s chat.

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!

Market Update - March 2024

Total home sales and inventory remain incredibly low. I hate to sound like a broken record, but just when you think we can’t go any lower, here we are which means… prices are rising.

Market Action Index - March 2024

Total home sales and inventory remain incredibly low. I hate to sound like a broken record, but just when you think we can’t go any lower, here we are which means… prices are rising.

Most people in the industry are in a staredown with the FED. The policy has been restrictive and almost everyone would like to see just a neutral stance in order to alleviate some of the pressure on the market. It’s much of the same story. Most potential sellers are rate locked into their current homes and even if they wanted to sell, they can’t. The Federal Reserve really does hold the key to unlocking everything. I for one, understand and agree inflation was/is an issue. The cost of EVERYTHING has exploded over the last 3 years. However, I would also say that the restrictive policy is bringing a ton of frustration to anyone who’s considered a move in the last couple years.

When you consider the recent news about commissions, Realtors have become the lightning rod for all of the angst and frustration. Trust me when I say, Realtors, are even more frustrated. I can only speak for myself, but owning a home is part of the American dream. I want that for as many people as possible. We also have a fiduciary duty to get our sellers the biggest return on their investment. After all, they took the risk in buying the home and it’s them solely who have maintained it and paid the mortgage every month. There’s still opportunity in the market. Homes are being listed and sold as I write this. Are the windows tighter? Yes they are, but they’re out there. If you’re a buyer, hang in there. If you’re a seller, you’re in a great spot. Questions? Just reach out!

Market Segments - March 2024

“Evidence of this heightened competitiveness is clear: homes are selling faster than ever before, with the median time on market plummeting from 42 days in 2023 to just 20 days last week. ”

Market Profile - March 2024

HOT TOPICS

Would you like a free home report every month? Those receiving these have really enjoyed them, over 85% open rate! If you’d like a free home report every month, all I need is your address and an email for you. It’s a great way to track home values, loan information, payoff ideas, and what you might be able to rent your home for. Send me an email brendan@vshometeam.com to be added!

Fed makes no moves… yet - The Fed decided to keep rates steady in their latest meeting, as expected. They still plan to cut rates three times by the end of 2024. Recent economic reports showed stable inflation and a solid overall economy. The focus was on future rate cut projections, aligning with their previous expectation of three cuts in 2024. The news was more upbeat than anticipated, leading to an improvement in the bond market and slightly lower mortgage rates after the announcement.

CA job loss now worse than prior to Covid - In February, California's jobless rate climbed above its pre-pandemic average, according to the latest report from the Bureau of Labor Statistics. While most states saw steady employment growth, California experienced a decline of 3,400 jobs, ending a six-month streak of gains. The state's unemployment rate rose to 5.3%, up from 5.2% in January. Construction and trade/transportation sectors saw the biggest job losses, possibly due to weather conditions.

Mortgage applications dipped - The Mortgage Bankers Association's Market Composite Index fell 1.6% from the previous week ending March 15, 2024. Both purchase and refinance activity decreased due to rising mortgage rates driven by hotter-than-expected inflation. Uncertainty about the Fed's rate cuts led to rate volatility, contributing to the decline in mortgage applications. However, following the latest FOMC announcement, rates may ease, potentially boosting mortgage activity in the upcoming week.

Things are heating up, if buying or selling has crossed your mind. Let’s chat.

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!

Market Update - February 2024

Market competitiveness ramping up… with inventory levels at historic lows, buyers are facing increased competition even before the traditional Spring homebuying season begins. Evidence of this heightened competitiveness is clear: homes are selling faster than ever before, with the median time on market plummeting from 42 days in 2023 to just 20 days last week.

Market Action Index - February 2024

Well, as always, an interesting start to the year. My passion for this topic aside, it’s going to be an FASCINATING year. First, home buying activity is up, but I would say more ‘shoppers’ than buyers right now. Affordability is still brutal and about to get worse with prices rising. The FED has remained hawkish on rate cuts. As a result, even though rates have dropped since late last year, MOST of us in the industry were hoping for more positive movement by now. It will remain to be seen if we have somewhat of a ‘late’ seasonal surge. That’s my prediction for now. Overall, if you’re a buyer you MUST be prepared to be aggressive in whichever segment of the market your buying in. And, aggressive doesn’t mean reckless.

However, you need to know what you want and what calculated risks you’re willing to take. The strategy is the fun part, feel free to reach out and ask how I get my buyers into homes with minimal risks. As a seller, you again find yourself in great territory with many sellers being able to call the shots. However, pricing and presentation still remains incredibly important and can cost you serious cash if not handled the right way. Why does January seem so long and February seem so short, other than the obvious (2-3 days)?? Spring is almost here!

Market Segments - February 2024

“Evidence of this heightened competitiveness is clear: homes are selling faster than ever before, with the median time on market plummeting from 42 days in 2023 to just 20 days last week. ”

Market Profile - February 2024

HOT TOPICS

Would you like a free home report every month? If you’d like a free home report every month, all I need is your home address and a good email for you. I’ve been getting great feedback from everyone who is getting them. It’s a great way to track home values, loan information, payoff ideas, and what you might be able to rent your home for. Send me an email to brendan@vshometeam.com to be added!

Market competitiveness ramps up - With inventory levels at historic lows, buyers are facing increased competition even before the traditional Spring homebuying season begins. Evidence of this heightened competitiveness is clear: homes are selling faster than ever before, with the median time on market plummeting from 42 days in 2023 to just 20 days last week. Furthermore, the trend of homes selling above list price is on the rise, with nearly half of all closed sales achieving this feat last week alone.

Rates comes down slightly - Last week, average consumer rates saw a slight dip, easing from 6.9% to 6.77%. However, despite this decline, daily rates quoted in the marketplace remain above 7%. Economic indicators suggest that rates may not decrease rapidly, with forecasts pushing potential Fed rate cuts to the second half of the year. As a result, some prospective homebuyers may choose to enter the market sooner and consider refinancing later, rather than waiting for anticipated rate drops.

What crash? - Good news for California homeowners: the majority are keeping up with payments and have substantial home equity. With only 2.5% of mortgages delinquent, nearly 98% of homeowners are meeting their payment obligations. Additionally, almost all homeowners in California have at least 20% equity in their homes. Even in a worst-case scenario of a price correction, most homeowners would still retain positive equity, minimizing the risk of distressed sales in the event of an economic downturn. There remains no data to support an oncoming crash of home prices.

Things are heating up, if buying or selling has crossed your mind. Let’s chat.

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!

Market Update - January 2024

Happy New Year! The calm before the storm, the lag effect, tranquility before chaos, silence before all hell breaks loose…however you want to say it. We’re there…lot of people in the industry are talking about how quiet it is right now. We’re in the holding pattern but come March 1….LOOK OUT…

Market Action Index - January 2024

Happy New Year! The calm before the storm, the lag effect, tranquility before chaos, silence before all hell breaks loose… however you want to say it. We’re there. A lot of people in the industry are talking about how quiet it is right now. We’re in the holding pattern, but come March 1st, LOOK OUT. It’s going to be ON. There are a number of buyers and sellers watching rates like a hawk. The FED has promised rate cuts as we dive into 2024 and for buyers it’s a blessing in an attempt to make buying a home affordable again. Sellers that are looking to sell their current property and move into another property are also watching to see if those interest rates gets into the 5’s or maybe even the 4’s. Keep an eye on the data; it will tell the story. Inflation, job reports, and 10 year treasury yield… I’m confident we’re going to see more transactions this year. This is what happens in a healthy market! Let’s see (and hope) if I’m right. Cheers to 2024!

Market Segments - January 2024

“Empty-nest baby boomers own 28.2% of the three-bedroom-plus homes in the country, while millennials with children own just 14.2%.

This disparity comes even as more millennials (28%) than baby boomers (27%), make up the adult population of the U.S.”

Market Profile - January 2024

HOT TOPICS

Would you like a free home report every month? If you’d like a free home report every month, all I need is your home address and a good email for you. I’ve been getting great feedback from everyone who is getting them. It’s a great way to track home values, loan information, payoff ideas, and what you might be able to rent your home for. Send me an email to brendan@vshometeam.com to be added!

Small business optimism closed the year on a high note - The NFIB index, a gauge of U.S. small business sentiment, increased by 1.3 points to 91.9 in December. This marked the first uptick in five months, tying the 2023 high from July. The economy's resilience boosted business outlook, driving optimism upward at the year's end. Although sales expectations improved in December, they still stayed in negative territory. Inflation posed the main challenge for small businesses last month, while hiring remained difficult for many owners. The index is below the historical average for the 24th consecutive month.

Inflation climbed more than expected in December - Consumer prices rising 0.3% month-over-month and 3.4% year-over-year. Economists were anticipating a 3.2% increase in the Consumer Price Index (CPI) for the month, slightly up. The boost in overall prices was mainly driven by a 6.2% year-over-year increase in shelter costs. Core CPI, excluding food and energy, dropped to 3.9% in December from November's 4%, marking the first time in two and a half years it fell below the 4% threshold. Despite a slight rise in headline CPI, inflation is gradually easing, but the downward trend is slow. Looking ahead, the expectation is for further decline, with the headline CPI likely dropping below 3% year-over-year by the end of 2024.

Mortgage rates edged up in the second week of 2024 - AKA the Highest level in three weeks. This uptick is partly due to positive economic data and some uncertainty about the Fed's future rate cuts. However, recent data suggests a turnaround as fresh inflation reports keep hopes for low rates alive. With CPI slightly higher than expected, rates may experience some volatility in the weeks ahead. Despite this, lower rates at the beginning of the year led to a 9.9% week-over-week surge in mortgage applications, bringing some homebuyers back into the market, according to the Mortgage Bankers Association.

Foreclosures in the U.S. went up in 2023 - reaching 357,062, a 10% increase from 2022 but still 28% lower than 2019 levels, says ATTOM. Despite the bump, foreclosure activity remains well below the Great Recession peak, dropping 88% from 2010. These filings accounted for 0.26% of all U.S. housing units, a slight rise from 2022 but a decrease from 2019 and a significant drop from the peak in 2010. With expected home price increases and a mild economic growth in 2024, foreclosure activity may fluctuate but is not anticipated to sharply rise in the next year.

If you need that PUSH, this is it. You need a plan even if you don’t have your stuff together. Call me and let’s make your vision come true!

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!

Market Update - December 2023

Let’s be honest, December is really an opportunity to look forward to 2024. 2023 had the lowest number of homes sold in decades. It’s been a tough market for both buyers and sellers, despite it still being advantageous to be a seller in San Diego (maybe for eternity??)…

Market Action Index - December 2023

Let’s be honest, December is really an opportunity to look forward to 2024. 2023 had the lowest number of homes sold in decades. It’s been a tough market for both buyers and sellers, despite it still being advantageous to be a seller in San Diego (maybe for eternity??). We’ve had sellers who would like to sell, but feel locked in by their current mortgage rate. Then there’s the buyers… sigh. Inventory was down, prices AND interest rates were up. It’s been a rough go in 2023, but things look to be improving as we race down the stretch to 2024. Currently, we’re seeing home prices stay the same or increase, but we’re also seeing days on market increase. It’s harder to sell homes right now than it has been in the past 2.5 years. Until we saw a slight decrease in interest rates, new buyers had had enough and I don’t blame them. Affordability is at an all time low. However, with rates rallying and the FED seemingly done increasing rates we could see lots of action in the first quarter of 2024, especially if rates are in the 6’s and buyers have the opportunity to ‘buy’ down their rate into the 5’s! This changes the ballgame. You have to ask yourself, which sellers does this potentially bring off the sidelines?? Only time will tell, but if trend continues I expect early 2024 to get going sooner than the traditional spring/summer selling season. I have to say, personally, I’m all for it. We need to see positive movement in the market place. We need to see transactions, ideally fair and prosperous for both buyers and sellers. 2024 could be a great year for everyone in the real estate marketplace!

Market Segments - December 2023

“With rates reaching a 23-year high in late October, the share of consumers who said that it would be a good time to buy reached a new survey low at 15%.”

Market Profile - December 2023

HOT TOPICS

Would you like a free home report every month? If you’d like a free home report every month, all I need is your home address and a good email for you. I’ve been getting great feedback from everyone who is getting them. It’s a great way to track home values, loan information, payoff ideas, and what you might be able to rent your home for. Send me an email to brendan@vshometeam.com to be added!

Mortgage rates hit a four-month low - Interest rates drop for the sixth consecutive week due to softer economic data signaling a slow-down in inflation. Last week, Freddie Mac reported a 19 basis point decrease in the average 30-year fixed rate mortgage, totaling a 76 bps drop since its late October peak. The job market seems to be stabilizing, showing signs of softening, but remaining steady. This week might see rate fluctuations following Tuesday's November Consumer Price Index (CPI) release and the Fed's announcement on their next rate hike, scheduled for Wednesday.

Homeowner equity made a comeback in Q3 - Homeowner equity increases after a slight dip earlier in the year, per CoreLogic. In the U.S., homeowners with mortgages saw a $1.1 trillion increase in equity since Q3 2022, a 6.8% yearly jump. Properties with negative equity dropped by 7.7% from Q2 and 8% from Q3. Only about 2% (1.1 million) of mortgaged properties were underwater, way lower than the 26% peak in Q4 2009. On average, U.S. homeowners gained $20,000 in equity last quarter compared to a year ago. California ranked second in equity gain, with an average increase of $51,000 in Q3 2023. The state had the smallest share of homes with negative equity at 0.6%.

November's job report was better than expected - November’s job report showed 199k jobs added, thanks in part to the resolution of strikes in entertainment and auto industries. Unemployment dropped to 3.7% from October's 3.9%, with more people entering the job market. However, the job market seems to be cooling despite these numbers. Retailers saw their smallest yearly hiring increase in three years in October, continuing in November with a decline of 38k jobs. While the 3-month average of nonfarm payroll remained solid at 204k between September and November, it's notably slower than last year's 300k plus average at the same time.

Consumer sentiment surged in early December - Consumer sentiment jumped 8.1 points to 69.4 from November's 61.3, the biggest increase since March 2021 and beating expectations. This boost came largely from improved inflation expectations, with the one-year outlook dropping from 4.5% to 3.1%, the largest one-month dip in 22 years. With inflation easing and interest rates at a four-month low, consumers' views on the future economic outlook also improved. The index for consumer expectations shot up from 56.8 to 66.4 in December, potentially impacting holiday spending positively for the year's final stretch.

With only 19 days until 2024 I have started to solidify my goals for next year, have you? Is buying or selling your home something that’s on your mind? If so, let’s talk about when is the best time to buy or sell. I hope you have a Merry Christmas and a prosperous New Year!

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!

Market Update - November 2023

The consensus is that we finally hit the high point on interest rates for the foreseeable future. Over the last few weeks we have seen a big dip that puts rates near their lowest point in the last couple months. If the FED doesn’t intervene, it does look like we’re going to see some relief as we move into 2024…

Market Action Index - November 2023

The consensus is that we finally hit the high point on interest rates for the foreseeable future. Over the last few weeks we have seen a big dip that puts rates near their lowest point in the last couple months. If the FED doesn’t intervene, it does look like we’re going to see some relief as we move into 2024.

Additionally, inflation is down, but so is consumer spending and holiday season hiring. That is likely indicating that most consumers are anticipating a bit of an economic downturn. Home buying sentiment was rough in October with just 15% of people thinking it was a good time to buy a home. Low inventory is still a factor which has kept home prices high even if median home prices have dropped over the last month. Coupling, home buying sentiment (due to affordability) along with low inventory has led to a super funky market. It’s plain weird out there right now folks. I’ve had a great home in escrow 3 times with the first two buyers getting cold feet and just canceling for no good reason. Additionally, I had a buyers offer (at list price) not accepted and then the seller withdrew the home completely from the market… As weird as it is, we have worked in these types of market conditions before and we will again. It may not seem like it, but it WILL settle down… eventually. I think 2024 is going to be a much more stable and free flowing year than 2023. It has to be… right?!

Market Segments - November 2023

“With rates reaching a 23-year high in late October, the share of consumers who said that it would be a good time to buy reached a new survey low at 15%.”

Market Profile - November 2023

HOT TOPICS

Would you like a free home report every month? - If you’d like a free home report every month, all I need is your home address and a good email for you. I’ve been getting great feedback from everyone who is getting them. It’s a great way to track home values, loan information, payoff ideas, and what you might be able to rent your home for. Send me an email to brendan@vshometeam.com to be added!

Mortgage rates dropped for the third week straight! - After spiking for about two months, the average 30-year fixed-rate mortgage by Freddie Mac fell to 7.44% last week, down around 35 basis points from its late October peak of 7.79%. Mortgage News Daily had rates climbing over 8% for a few days in October but now they're trending below 7.4%. Rates are still much higher than last year, putting a damper on buyer interest, but this recent dip seems to be helping mortgage applications pick up a bit. However, they haven't turned positive yet.

Holiday job demand has dropped, hinting at slower job growth ahead - Economists predict an economic slowdown as spending decreases. Businesses plan to hire fewer seasonal workers this year compared to last year. Recent Labor Department data show a decline in hiring by warehouses and transport companies, typically big seasonal employers. While retailers still hired 60,000 more workers in October than last year, it's the smallest increase in three years during the usual hiring surge. This shift suggests a more cautious approach from employers uncertain about the upcoming business landscape after two years of aggressive hiring.

In October, folks were feeling (a little) better about inflation - Gas prices went down and food prices plus rent started to steady, making people think inflation might ease up. Expectations for both short-term and long-term inflation dropped a tad from September. The one-year outlook went from 3.7% to 3.6%, and the five-year outlook slipped from 2.8% to 2.7%. However, home prices are still expected to rise by 3%, higher than the usual 2.1% average. College and medical costs are predicted to jump up next year by 6% and 9.1% respectively. People are expecting their household income to only grow by 3.1%, which explains why inflation worries are still lingering.

Credit card debt in the US has soared past $1 trillion since August, hitting a record high - This surge, around $170 billion more than pre-pandemic levels, is a big reason behind ongoing strong consumer spending while personal savings rates drop back to low single digits. Right now, credit card delinquency and charge-off rates are relatively low, hovering around 3%, but they've been going up this year and are almost double compared to their lows in 2021. The big question is whether consumers can keep driving the economy next year, dealing with higher borrowing costs, reduced savings, and increasing debt levels.

California's mortgage delinquencies barely moved despite interest rates shooting up this fall - The Mortgage Bankers Association found that only 2.3% of all mortgages were behind in the third quarter of 2023, a small increase from 2.2% in the previous quarter. It's not a big jump in troubled mortgages. Most Californians have mortgages with rates below 6%, making it easier to stay on top of payments. While these low rates might slow down home sales as owners stick with their current mortgages, they're preventing a spike in delinquencies that could trigger another foreclosure mess.

I don’t know about you, but I’m ready for a little break. I’m looking forward to Thanksgiving and spending some quality time with my family. Hope you are able to find some time to relax too!

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!

Brendan

Market Update - October 2023

Owning a home still rocks - The Federal Reserve's 2022 Survey of Consumer Finance just dropped. It revealed that most of the moolah in the U.S. is made by homeowners. Last year, the average U.S. household's worth hit $192,900 (adjusted for inflation). But get this: homeowners' median net worth was a cool $396,200. Renters, on the other hand, were lagging way behind at just $10,400.

Market Action Index - October 2023

Since I have hosted a couple open houses in the last month, I have had the unique experience of chatting with over 40 groups of potential buyers. What I’m noticing is that home buying demand is there, but the affordability is debilitating. I’m not sure how many of those 40 were serious buyers, but my guess is about 25%. My qualitative, unofficial take is that the home has to be darn near perfect for buyers in order for them to make an offer. And I don’t mean the home is perfect (none are), but that it’s perfect FOR them.

Interest rates continue to push higher and even touched 8% for a period over the last week. The FED seems content to hold, and I’m not sure that will change given the economic data regarding jobs and consumer spending. See more these topics in the hot topics section below.

Market Profile - October 2023

HOT TOPICS

Owning a home still rocks - The Federal Reserve's 2022 Survey of Consumer Finance just dropped. It revealed that most of the moolah in the U.S. is made by homeowners. Last year, the average U.S. household's worth hit $192,900 (adjusted for inflation). But get this: homeowners' median net worth was a cool $396,200. Renters, on the other hand, were lagging way behind at just $10,400. That's barely $1,000 more than the peak back in '95. Bottom line? Renting just doesn't cut it for building wealth. So, having your own place is the smart money move for the long haul.

Consumers aren't bothered by rates or debt - Credit card debt has shot up by almost $150 billion since before the pandemic, but folks are still spending. In September, retail sales kept climbing, especially in the services sector. Some credit card debts are turning sour, but people are still hitting bars, hotels, and restaurants hard. Even after factoring in high inflation, real retail sales are more than 10% above pre-pandemic levels from January 2020. With consumers making up nearly 70% of the U.S. economy, this could mean a stronger Q3 economic growth than expected. So, don't expect any rate cuts from the Federal Reserve until next year.

Rates keep going up as the bond market embraces "Higher for longer." - The average 30-year fixed mortgage rate hit over 8% twice in the past week. This is because the bond market is okay with the Federal Reserve's plan to keep rates high for longer than expected. The 10-year Treasury rate is getting close to 5%, despite the Fed Chairman saying they won't raise rates this year. People are also flocking to safe U.S. Treasuries due to Middle East tensions and oil supply concerns. While this makes the yield curve, which predicts recessions, less inverted, it means we're stuck with higher mortgage rates likely until the end of the year.

California's housing scene takes a hit as rates climb - Housing stock in California remains super tight, even compared to recent years. But here's the scoop – the recent rate hikes are starting to put a dent in the homebuyer frenzy. Home sales dropped to around 240,000 units last month, a tad above the low point in November 2022 when they hit 235,000 units. It's clear that getting back to "normal" levels of transactions will be a bumpy ride. Home prices are still inching up, despite a small dip from August due to the season. The median price of an existing single-family home in California has gone up for the third month in a row compared to last year.

Job market stays strong, but unemployment goes up - In September, California saw around 9,000 new jobs added. Industries like tourism, bars/restaurants, entertainment, and healthcare were up, but manufacturing, tech, and professional jobs took a hit. Sadly, the unemployment rate bumped up to 4.7%, with over 900,000 folks jobless for the first time in a year and a half. This uptick in unemployment hints that the job market might not be as robust as it seems. And data from the state's unemployment insurance payments, albeit a bit outdated, supports the idea that things might be weaker than the headlines suggest.

I don’t know about you, but I’m ready for a little break. I’m looking forward to Thanksgiving and spending some quality time with my little family. Hope you are able to find some time to relax too!

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I live on referrals (and will love you forever) if you send someone my way. It’s among the greatest compliments I can receive. I will treat them like family. Thank you in advance!

Brendan

Market Update - September 2023

Well…. we hit a new high in interest rates (over 7%) since June of 2001. Just before 9/11 for those tracking history. The market has slowed considerably, with the last two months being some of the worst sales months in the last 40 years…

Market Action Index - September 2023

Well…. we hit a new high in interest rates (over 7%) since June of 2001. Just before 9/11 for those tracking history. The market has slowed considerably, with the last two months being some of the worst sales months in the last 40 years. ”Low inventory made for a sluggish purchasing month with 2,435 sales, which is the second-lowest sales month for July in records dating to 1988.”

I do have a listing coming on the market at the end of the month, but that’s because the owners are moving into assisted living. They aren’t going to buy back into the market after selling. These situations along with anyone leaving the state are really the only listings that are going up right now. One thing that could change is if the labor market continues to soften and we have more distressed sellers entering the market. Not because they want to, but because they have to… more on labor market and mortgage delinquency rates (historically low) in the hot topics below.

Homes prices are at all time historical highs. This means if you have the cash, can afford the current rates, and/or want to move out of state or just sell and get out of the real estate game, NOW is as good as a time as ever. It’s hard to predict how long this will go on.

Market Profile - September 2023

However, if rates start to drop, prices are going to continue to go up UNTIL whatever that magical interest rate is where the current 2-3 percenters would consider selling. There will be a breaking point with the dam that’s holding all the inventory back. That is, if we ever get THAT low. My guess is that we really would have to be back in the low 5’s or high 4’s to get most sellers to consider listing.

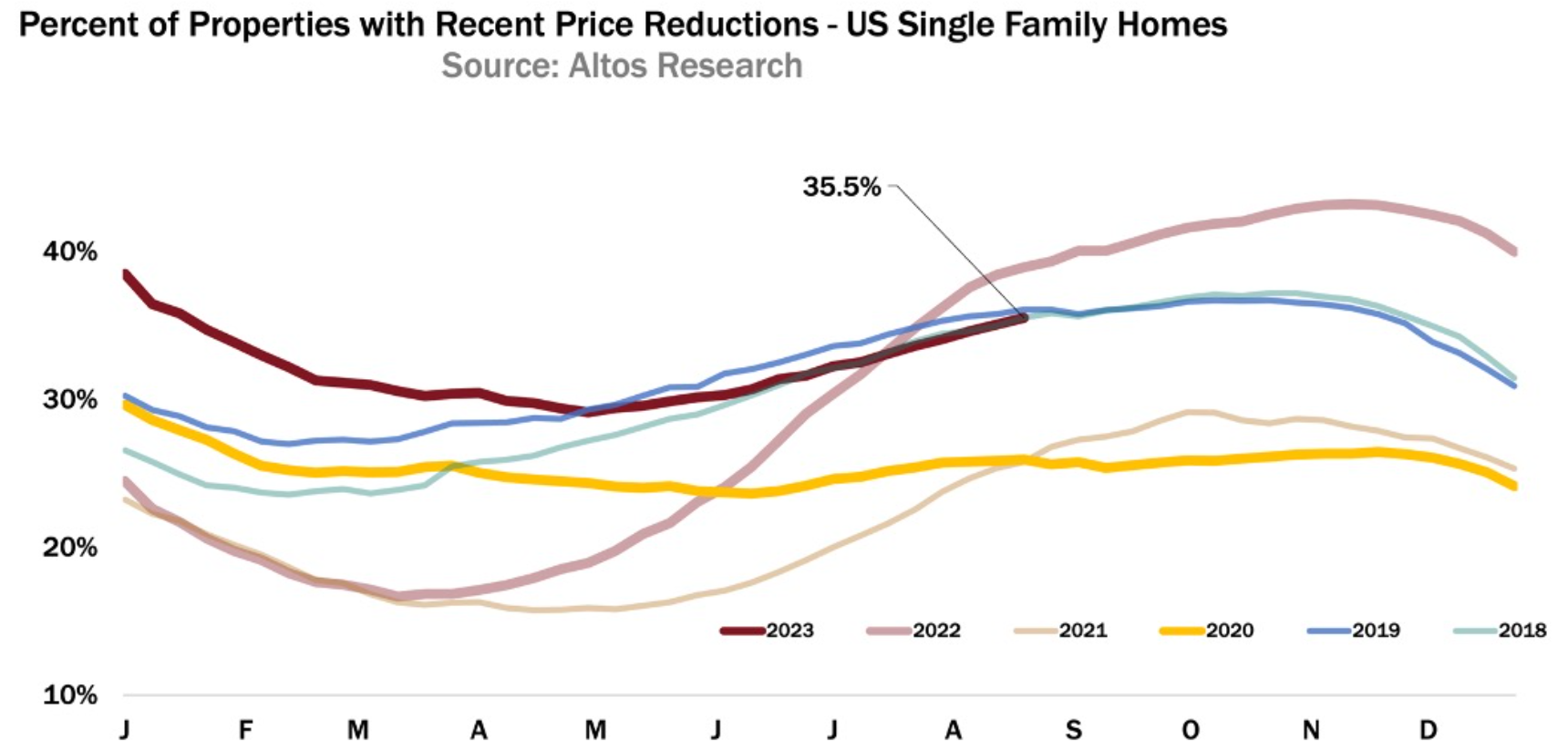

Days on the market is staying pretty level and there is a LITTLE more inventory, but let’s not kid ourselves. There’s not much out there. One thing to keep an eye on is days on market AND how many price reductions are being done. This would indicate that more buyers have taken to the sideline and are so frustrated they’re taking their ball and going home. I don’t blame them.

“Low inventory made for a sluggish purchasing month with 2,435 sales, which is the second-lowest sales month for July in records dating to 1988.”

September 2023 - Price Reductions trending up…

HOT TOPICS

Cooling labor market - In August, U.S. employers added 187,000 jobs. However, the job growth has slowed for three consecutive months, averaging 150,000 per month. The unemployment rate rose to 3.8% due to factors like the Yellow trucking firm shutdown and entertainment industry strikes. Looking ahead, there's less optimism for hiring and expansion, with only 38% of respondents in the third-quarter. Chief Human Resources Officer Confidence Index is expected to increase hiring in the next six months, down from 51% in the previous quarter.

Mortgage rates dip for the first time in six weeks - After rising for five straight weeks, the average 30-year fixed-rate mortgage, as reported by Freddie Mac, dipped at the end of August but stayed above 7%. This drop could be linked to concerns about a cooling job market, slowing consumer spending, and a downward revision of second-quarter GDP.

While it's expected that the Fed will keep their policy rate steady in the upcoming September meeting, mortgage rates are still high, and the market may remain volatile until the Fed provides a clearer signal on its next move. With borrowing costs near record highs and a tight housing supply expected for the rest of the year, home sales might stay sluggish in the coming months.

Consumer confidence slips - In August, consumer confidence took a hit due to a slower job market and rising food and energy prices. The U.S. Consumer Confidence Index, released by the Conference Board, dropped to 106.1, falling short of the expected 116.0. Factors like fewer job opportunities, higher interest rates, and a less positive stock market performance in August contributed to this decline. The upcoming resumption of student loan payments in October, affecting over 43 million borrowers, might also dampen consumer spending on goods and services, although the overall economic impact is expected to be relatively minor.

Delinquency rate remains near all-time low - In June 2023, the U.S. mortgage delinquency rate dropped to 2.6%, down from 2.9% in June 2022 and remained unchanged from May 2023. This rate is close to its all-time low and much lower than the peak during the 2009/2010 housing market crash. The national foreclosure rate also stayed low at 0.3% in June 2023, the same as in June 2022. In California, the foreclosure rate was just 0.024%, or one in every 4,188 households, according to ATTOM Data's July 2023 report. This is a significant improvement from the double-digit rates seen during the Great Recession. The counties with the highest foreclosure rates in California were Yuba, Shasta, Sierra, and Tulare.

One last note I will remind you is that we have a long list of trusted contractors and resources for any and all things related to your home. If you need a contract person, please let me know!

I’m in no rush but certainly feels like we’re sprinting towards the holidays… what happened to this year??! I'm here for anything you need. Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I live on referrals (and will love you forever) if you send someone my way. It’s among the greatest compliments I can receive. I will treat them like family. Thank you in advance!

Brendan

Market Update - August 2023

Well….that’s strange. Feels like a phrase I’ve used repeatedly over the last few months. This month, for better or worse, is no different. San Diego home prices are back up 3.1% YOY (year over year) BUT there are fewer sales….

Market Action Index - August 2023

Well…. that’s strange. Feels like a phrase I’ve used repeatedly over the last few months. This month, for better or worse, is no different. San Diego home prices are back up 3.1% YOY (year over year) BUT there are fewer sales…. Among things that appear to be the new normal is the shortage of inventory. “San Diego had 2,581 home sales in June — the lowest for that month in records going back to 1988.” In fact, I have a potential listing coming in my neighborhood which consists of almost 2,000 homes. If this owner decides to list their home right now, they’d be the only single family home on the market that’s less than 2,000 square feet. Let that sink in. It’s extremely advantageous to sellers who don’t intend to purchase - OR - are taking their California dollars elsewhere. Median list prices have generally stayed the same over the last month. Where we are seeing some change is both in DOM (days on market) and the number of offers received on homes we’ve listed. 15 months ago we would see double digit offers on most of our listings. Today we’d be happy to have 5. What hasn’t changed in the last 15 months is the prices of those offers. We’ve come complete full circle since home prices started to lose ground about this time last year.

Market Profile - August 2023

The big headline is always centered around interest rates - where are they headed and what is going to happen when. I wish I had the answers to each of those questions. I’d be selling my economic predictions, not houses if that were true.

Interest rates have been on the rise since April and recently hit a nine-month high. The average 30-year fixed-rate mortgage jumped to 7.24% . This rise was expected to slow down after July's lower inflation, but rates kept climbing. Oil and food prices, along with the chance of a smooth economic slowdown in 2024, made some think the Fed might not raise rates again. However, rates have been going up despite inflation cooling, and they'll likely stay high through the third quarter until the Fed clearly signals its next move.

“San Diego had 2,581 home sales in June — the lowest for that month in records going back to 1988.”

Median Home Prices on the rise…again - August 2023

HOT TOPICS

Housing Affordability - C.A.R. (CA Assoc. of Realtors) just dropped its latest report on housing affordability in California. Only 16% of households can actually afford a regular single-family home - the lowest since ages ago in 2007. Mortgage rates shot up, making borrowing crazy expensive. Mortgage payments spiked 8.1% from Quarter 1 of 2023 and 5.3% from Quarter 2 of 2022. You'd need at least $208,000 in income to cover a $5,200 monthly payment on a mid-priced home, assuming a 30-year fixed-rate mortgage of 6.61%. This income requirement hit a new high in Quarter 2 of 2023, the second time it passed $200,000 in three quarters. With interest rates staying sky-high, housing will stay tough on the wallet for hopeful homebuyers in the next few quarters.

Inflation - Even though prices are going up by about 3.2% year-on-year, the monthly bump of 0.2% in July wasn't as big as last year's 0.5% average hike. The basic cost of living, without some extra stuff, went up a bit slower too, from 4.8% in June to 4.7% in July. Over the last three months, prices only went up around 3.1%, which is the slowest since September 2021. House prices are still high. Used cars and trucks are getting cheaper, and plane ticket prices took a nosedive compared to last year. But don't get too comfy – gas prices are climbing again, and food prices for businesses are going up too. Political tensions and weird weather might mess with prices for food and energy, and the trend of prices going down might flip in the next few months.

Consumer Sentiment - After hitting a high not seen in almost two years in July, the University of Michigan's consumer sentiment report barely moved in August. The index for August 2023 ticked down a tad , but it's still way better than the rock-bottom it hit in June 2022. People felt a bit better about prices, with their guess for inflation in the next year going down. Even though folks seem to think inflation is chilling out, they're not changing their minds about interest rates. Most folks still think interest rates are going up in the next year.

Small Business Optimism - Small businesses got a bit more upbeat in July, making the index rise for the third month in a row to 91.9. Still, even with this bump, it's been 19 months straight below the usual score of 98. Business owners were feeling better since prices weren't going up as fast, things were looking up economically, and they thought they'd sell more stuff in the future. The boost in good vibes also means more spending ahead, with 27% of owners planning to invest more money in the next few months, up a couple of points from June.

Now more than ever, let's buckle down and keep pushing forward. Things will improve, but it won't be an instant fix. It's like we're all in survival mode, and really thriving might have to wait until another phase of life. Let’s remember there's still plenty of chances out there. Keep an eye on new construction – builders might offer sweet interest rates. It could mean the difference between snagging a home now or waiting until next year. Have an awesome August! We’re all getting ready for school to start again. I'm here for anything you need. Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I live on referrals (and will love you forever) if you send someone my way. It’s among the greatest compliments I can receive. I will treat them like family. Thank you in advance!

Brendan

Market Update - July 2023

I find myself wanting to journal about the market versus writing an actual market report because its so frustrating. I truly feel like a broken record, but it’s not a healthy market by any stretch. I want better for my clients; I want better for families; I want better for my community, and I want better for our country. Alright, that’s enough from my ‘journal’ entry for now…

Market Action Index - July 2023

I find myself wanting to journal about the market versus writing an actual market report because its so frustrating. I truly feel like a broken record, but it’s not a healthy market by any stretch. I want better for my clients; I want better for families; I want better for my community, and I want better for our country. Alright, that’s enough from my ‘journal’ entry for now.

Market Profile - July 2023

Median home prices have actually dropped from last month. I think we’re feeling the effects of really high interest rates and an uptick of uncertainty. Buyers are now sitting and waiting to pounce. I think most buyers have figured out there won’t be a crash. They’re happy to wait out the interest rates to get in, even if that means they’re paying $100K more on the same property in 6 months. Days on the market are down, inventory is up (albeit slightly), and median rent had a huge jump of 6% month over month. Median rent is now $4,250… that’s more than my mortgage. There doesn’t seem to be any signs of that slowing down.

I had a post recently explaining that historically speaking, rates have averaged just under 8% since we started tracking the data in 1971. The difference is that home prices are approaching all time highs again. What’s important to you, as it is to me, and any other normal family, is what your monthly payment comes out to. It’s all about perspective. Rates will come down. There’s no question about it. Wages growth is now outpacing inflation (Figure 4) for the first time in two years. That’s a big change. One of the things that is keeping interest rates from coming down is the jobs report. We continue to add jobs in the economy. The other big change that is starting this fall is the student loan moratorium will come to an end. This means loan payments will be due again. However, there’s going to be an on-ramp period if you can’t make your payment. This means that during this time, payment will be due and interest will accrue. However, borrowers will not incur late fees, penalties, or negative credit reporting for missing payments. This poses a problem because the money that should be going to those payments (that’s been on hold throughout Covid) may now be spent on goods and services. This continues to stimulate the economy and prevents inflation from dropping as quickly.

“Median rent is now $4,250… that’s more than my mortgage. There doesn’t seem to be any signs of that slowing down. ”

Total Jobs continue to Rise -July 2023 (Figure 3)

I hate to belabor the point, but the hang up is interest rates. We need them to come down to loosen up this market. I’m predicting once they start to come down, prices are going to jump higher and higher until current homeowners that are thinking of selling can’t ignore the cash out any longer.

Employment is going to play a big part in decreasing interest rates, because it’s so directly related to inflation and distressed selling.

The FED is dead set on squashing inflation, even if it puts us into a full-fledged recession. More on interest rates and all the factors that are affecting them below.

HOT TOPICS

Mortgage rates - The FED didn’t raise rates at the last meeting, but after the jobs report and CPI data on inflation, the expectation is that the FED is going to raise rates again .25 - .50 point this month. They have raised rates 5% since last March. All in effort to curb the highest inflation in 40 years. Currently, rates are over 7% again on average.

Strong jobs report - Jobs continue to be added and there’s a total of over 4 million jobs than there was before Covid started. Keep that in mind, especially as the media headlines are dominated by reports of massive job loss. Jobs are a big part of what’s holding up inflation and subsequently interest rates.

Student loans - Just like jobs, student loans play a huge factor in monthly affordability. Anyone who has outstanding loans to pay will be impacted when the moratorium ends in September. As I mentioned already, lendees will be allowed to skip payments with no penalty or dings to the their credit, although interest will still accrue. This affects interest rates in two ways. One, this stimulates the economy because those dollars go to goods and services and not to debt. Two, debt is a major factor in your debt to income (DTI) ratio. If you’ve got student loan debt, it’s going to dramatically affect your budget when it comes to buying a home.

Homeowners Insurance Issues - This is a major issue that has come to light as multiple insurance carriers have decided to stop writing homeowners insurance policies in California for the immediate future. The worry is that others will join All State and State Farm in declining to insure homeowners. This issue is ongoing and will be closely monitored by all, but especially homeowners both future and current. For now, be aware this could affect your auto insurance as well. My advice is don’t try to change insurance carriers or plans, and make sure you pay on time. Do not give any of these carriers a reason or avenue to cancel your coverage.

Wage Growth vs. Inflation Graph - July 2023 (Figure 4)

I think more than ever, we just have to put our heads down and continue to grind. Everything is going to get better, but it’s not going to happen overnight. To some degree it feels like we all just need to figure out a way to survive; thriving will have to wait for another season of life. That being said, there’s still lots of opportunity out there. I would pay particular attention to new construction, because builders may have some opportunity to push some promotional interest rates. It could be the difference between getting into a home now and having to wait until next year. Have a wonderful July, I know my family and I are loving the sunshine. I’m here to help you with whatever you need. Call/text/message me :)

Brendan

P.S. I live on referrals (and will love you forever) if you send someone my way. It’s among the greatest compliments I can receive. I will treat them like family. Thank you in advance!

Brendan

Market Update - June 2023

It can be a long road to home ownership. Prices are up, days on market and inventory is down, and rates are in flux. The market is stickier than a still summer day in Kansas…

Market Action Index - June 2023

San Diego tends to be in a perpetual state that favors sellers over buyers. The only question lately is how much of a seller’s market is it? More than it has been since last June when the market was absolutely at its peak. Starting in July of ‘22, home prices started to track down as interest prices rose. That continued until March ‘23 where we started seeing interest rates settle in the 6’s.

Buyer demand has remained high and once you take a big GULP and swallowed the fact that interest rates have doubled - home prices have started to head north again.

Market Profile - June 2023

Home prices have really taken a large leap in the past month with median home list prices up almost ~$175K. They jumped from $1.349M to $1.575M in a month… I’ll let that wash over you. I hate to tell you that I’ve been telling you this for months, wait no actually I love telling you I was right about this ;) What I don’t like is how sticky the market has continued to be. I have to say, I don’t blame anyone for holding off on any major decisions, which includes buying or selling your home. Inventory and days on market are tracking down and most reasonable (both in price and quality) homes are in very competitive bidding wars. If you want to buy a home right now, you likely need to be aggressive in your offer both in terms and price. You DEFINITELY need to have a great agent who will put all of your ducks in a row. And of course, you need to pray to the San Diego housing Gods, wear your lucky socks, and run around at an aviary hoping a bird poops on you for luck… kidding… kind of.

“Owning a home in San Diego has become tougher in the past decade. In 2020, the homeownership rate fell from 54.4% to 53.5%, the lowest in 40 years.”

Home Prices on the Rise -June 2023 (Figure 1)

All of home price value that was lost between July ‘22 and February ‘23 has now been recovered (Figure 1). The real question continues to be what will happen with interest rates? We need them to come down to loosen up this market. I’m predicting once they start to come down, prices are going to jump higher and higher until current homeowners that are thinking of selling can’t ignore the cash out any longer. On top of the fact they may be able to stomach a rate in the 5’s if they want to buy a replacement property.

Employment is going to play a big part in interest rates, because it’s so directly related to inflation and distressed selling. It’s been a confusing stretch when it comes to jobs. Employers added 339,000 jobs in May, all while various well-known companies including Facebook, Google, McDonalds, Walmart, Microsoft and Goldman Sachs are cutting/or have cut jobs. Additionally, unemployment is up to 3.7% which is the highest it’s been since October - although historically still very low.

Keep a close eye on the consumer price index which is how we measure inflation. As that number decreases, so will mortgage rates. If it shows signs of an increase or stagnation, we’re going to see the FED raise interest rates again. The FED is dead set on squashing inflation, even if it puts us into a full-fledged recession.

HOT TOPICS

Mortgage rates dip slightly as debt ceiling crisis is avoided - The Freddie Mac survey just came out, and it looks like the average 30-year fixed rate mortgage went up to 6.79% for the week ending June 1, 2023. Here's the good news: thanks to progress on the debt ceiling agreement, the daily mortgage rates dropped from 7.14% earlier in the week to the high-6s again. New mortgage applications are still declining, but not by as much as before. The purchase index is still low, and homebuyer demand is expected to stay below pre-pandemic levels. That's because rates will likely remain in the 6-7% range until inflation goes down.

Exceptionally strong jobs report keeps pressure on the Fed - Even though the Fed has been trying hard to slow down the overall economy by increasing interest rates aggressively, the job market is still doing better than expected. In May, the U.S. economy added a whopping 339,000 new jobs, which was way more than what experts predicted. This shows that the labor shortage, which started during the pandemic is still a big issue. People are eagerly waiting to see if they'll raise rates once more at their meeting on June 13-14.

Consumer confidence slipping despite strong jobs data - Even though more jobs were created in May, people are starting to worry about their future job prospects. Consumer confidence, as a whole, went down a bit in May, but not by much. However, fewer people are saying that job opportunities are "plentiful," and few are quitting their jobs compared to even before the pandemic hit. As jobs become less easy to find, it might help ease inflation, but it also means that wages won't be growing as much. Along with less savings, increasing credit card debt, and stricter credit standards, this could lead to consumers taking a step back despite being the main force driving economic growth for the past three years. In fact, people's plans to buy expensive things in the near future were down across the board in May.

Fast Tracking Permits in unincorporated areas - The San Diego County Supervisors just gave the thumbs up to some new rules that will make it easier to build houses in unincorporated areas. It's hard to say exactly how much this will actually speed up home construction. In 2022, only 1,667 homes were built in unincorporated parts of the county, which is a measly 17 percent. Environmentalists are vocal about not building in the backcountry. They're worried about things like car pollution, the risk of fires, and other factors. And you know what? Judges often side with the environmentalists in lawsuits. Just last October, they put the brakes on a project to build 1,119 homes east of Chula Vista because of these concerns.

San Diego Homeownership rates vs. other counties in the state (2020).

In the last ten years, the dream of owning a home in San Diego has become even harder to achieve. The crazy high prices of houses have wiped away any progress that hopeful buyers made after the Great Recession. In 2020, the percentage of households who owned a home dropped from 54.4 percent a decade ago to 53.5 percent. That's the lowest it's been in forty years.

All that being said, if you’re considering buying or selling, please give me a call and let’s talk about if it makes sense to do it sooner rather than later.

Will sunshine come at any point this year??! I’m sure we’ll be complaining it’s too hot soon enough :)

P.S. I live on referrals (and will love you forever) if you send someone my way. It’s among the greatest compliments I can receive. I will treat them like family. Thank you in advance!

Brendan

Market Update - May 2023

Did you know? 50% of households are housing cost-burdened in San Diego, meaning these households spend more than 30% of their income on housing costs.

Market Action Index - May 2023