Market Update - January 2023

What's going to happen to the Real Estate market in 2023? Will prices continue to slide? What are the two biggest factors that will drive performance? Check out this month's update for answers!

Market Action Index - January 2023

December in Real Estate is traditionally one of the quietest times of the year. Most of us are ready for a break and ready to spend time with family enjoying the festivities. It leads to a little bit of a lull as we shift into the new year. For many, buying a house and packing up everything you own isn’t on your holiday agenda. However, because it’s slow means there’s opportunity for both buyers and sellers.

“Most of what happens in the real estate market is predicated based on what happens in the economy. Two big indicators to keep an eye on: inflation and jobs.”

Market Profile - January 2023

Buyers are waiting for more inventory to help alleviate price increases and sellers are worried they won’t be able to buy a replacement property. This is why I’ve been telling my sellers this is the best time to make contingent offers on your next home. It allows you to sell with confidence as you know where your next home will be!

Inventory dropped off dramatically, from low to really low! In fact, we saw the index swing higher toward a sellers market. As a result we saw an increase in median price by over $1M. This isn’t purely a pricing surge based on inventory levels, but it is an indicator that higher luxury priced homes are more likely to stay on the market longer and more likely to be immune to the seasons of real estate.

Looking forward to 2023, the consensus is that home prices will continue to drift down as more inventory comes back on the market and starts to normalize.

Most of what happens in the real estate market is predicated based on what happens in the economy. Two big indicators to keep an eye on: inflation and jobs. If inflation rates don’t subside neither will mortgage interest rates. This will make borrowing money more expensive and narrow the pool of potential buyers. If we see a decrease in rates, it will likely reignite the real estate market. Some buyers will feel pressure to take advantage of a lower rate. As far as job reports go, it really comes down to supply. Inventory is incredibly and historically low. One way we’d see an increase is if there’s an uptick in distressed selling - I.e. homeowners need to sell because they lost their job and can’t pay their mortgage.

As I have mentioned in this space before we are not primed for a crash, this is more of a correction in regard to what has transpired over the past two years. Depending on how jobs and inflation rates trend, we may even see a buyers market toward the end of 2023. No one really knows what will happen that far out, but it’s important for you to stay up to date with these reports so you’re informed as things change.

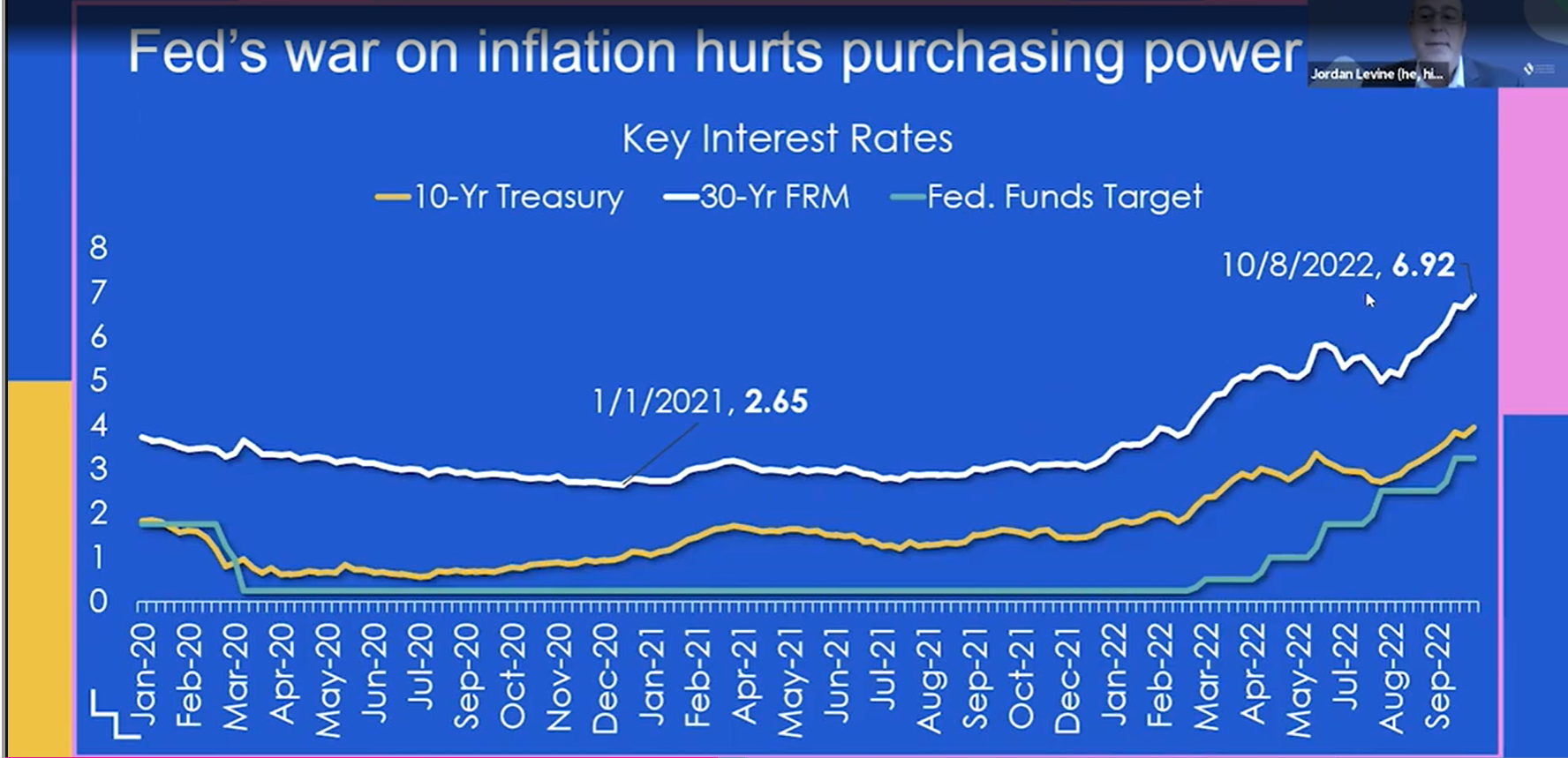

The FED has increased interest rates over 400 basis points in the past year. No one ever wants to hear this word again, but that dramatic of an increase is ‘unprecedented’. The reason for the increase is the FED’s continued effort to curb inflationary rates. While I believe increases are necessary, I’m concerned that it’s an overswing and it hugely impacts the economy. Additional aggressive increases could put the economy into a tailspin. The real litmus test is asking yourself how likely are you to make a big purchase right now? Gut feeling? My guess is you might be feeling hesistant at best and that’s a real indicator for where most of middle class America stands. The graph on the ‘Fed’s War on Inflation’ below gives a good idea of how all of these rates are linked to each other, most importantly as related to real estate, 30-year fixed mortgage interest rates.

Fed’s War on Inflation - January 2023

As always, if you know someone looking to buy or sell their home, I would love to connect with them and would be eternally grateful for the faith you have in me.

I hope you and your family have a wonderful beginning to the new year. Here’s to health and happiness in 2023!

Brendan

Market Update - December 2022

No one buys or sells homes during the holidays…right?? You’re likely swamped with holiday cheer but don’t think there’s not opportunity out there! Find out more in this month’s market report…

Market Action Index - December 2022

If you keep up with the Real Estate market, you know it has been slowly hitting the brakes for many months now. The holiday season is traditionally a slower time of year for most realtors for obvious reasons. Family comes first and there’s a lot going on. YOU have a lot going on and everyone is ready to shift into a lower gear as we head into 2023. I get it! That being said, there’s some really incredible opportunities to buy right now with sellers who missed the ‘Top’ and are feeling anxious to sell ASAP. Even though it may not seem like good time to buy OR sell, all it means is that this is the healthiest market we’ve seen in years.

“In fact the market has slowed down so much, only 30% of Realtors in San Diego closed an escrow in November. Fortunately, I happen to be one of those Realtors because of a wonderful referral from a past client. The reason? My clients are like family.”

Market Profile - December 2022

Median home prices are up, which is the result of more higher value properties on the market than price increases across the board. Mortgage rates are down almost a point since the begining of November, today 6.28% average for a 30-year fixed.

Did you know that 60% of properties on the market in November had 3 offers or less? This percentage has doubled since April 2022, when it was less than 30%. For buyers that have been constantly outbid, this is great news. If you’re a seller, keep in mind that just because there might be less offers in total that does not mean they’re not good. Homes are still being sold everyday!

Going back to April 2022 again - JUST 6% of listings reduced their price. Last month in November 2022 it was 43%... did I mention opportunity for buyers?! The fact is that sellers have taken some time to adjust to this market. Those of us in the business every day know that we’ve hit the ‘Top’ in terms of value (at least for this cycle) and it’s in the rear-view mirror now. This still doesn’t mean it’s a bad idea to sell in this market! Tons of qualified buyers are still out there and as I mentioned in last month’s market update, you’re still likely to do quite well as a seller if you bought in 2019 or earlier.

Mortgage Interest Rate Volitility - December 2022

In fact, the market has slowed down so much only 30% of Realtors in San Diego closed an escrow in November. Fortunately, I happen to be one of those Realtors because of a wonderful referral from a past client. The reason? My clients are like family. As always, if you know someone looking to buy or sell their home I would love to connect with them and would be eternally grateful for the faith you have in me.

I hope you and your family have a wonderful holiday season. Merry Christmas and Happy New Year from my family to yours. Cheers to the best year yet in 2023!

Brendan

Market Update - November 2022

Economic forecasts as we head toward the end of 2022 vary depending on what you read and where you get your news. However, one thing that has remained constant in the last month is the ever increasing mortgage interest rates and price reductions…

Market Action Index - November 2022

Economic forecasts as we head toward the end of 2022 vary depending on what you read and where you get your news. However, one thing that has remained constant in the last month is the ever increasing mortgage interest rates and home price reductions.

On Wednesday, November 2nd the FED announced another increase.

Market Profile - November 2022

It’s another 75 basis point increase, the 4th large increase in a row and the 6th time this year. While mortgage interest rates are NOT directly linked, it’s likely we will continue to see mortgage interest rates move upward. That being said, if you’re a buyer in the market, I would reach out to your mortgage broker to discuss locking in a rate prior to any additional increases. The FED remains determined to increase rates until inflation drops to their goal of 2%. All that being said, reach out to your mortgage broker. They can best advise you on what’s to come. If you don’t have a mortgage broker, I have a few brokers I trust and can refer to you at your convenience.

Percentage of Home List Price Decrease

Home prices have plateaued, but where we’re seeing a decrease is the median listing price. Additionally, about 40% of listings have undergone price reductions. A few things on price reductions… we’re still doing a lot education with sellers in regards to what homes should be listed at for today’s market. Today’s price is not what it was in January. If you’re a seller in this market, I wouldn’t be discouraged by the fact that you “missed the peak”. If you sold tomorrow you will absolutely benefit from all of the growth over the last 3 years. All that being said, gone are the days where we’d have 16 offers on a home within days of being on the market. The buyers that are out there right now are very meticulous and cautious. No one wants to buy a house only to watch it decrease in value over the next 12-18 months. They watch the same news we all do and they’re worried about a recession, similar to how you might feel. Homes that sell quickly right now are the ones that have been prepped for the market and priced correctly. Pricing your home correctly right now is absolutely CRITICAL. The most momentum for an offer will come in the first 2-3 weeks. If there’s no traffic, there’s no offers, then there’s ultimately no leverage. Buyers in this market will wait you out, trust me. And I’m saying that even with the threat of increasing mortgage interest rates. Overall, the longer your home is on the market the more lowball offers you’re going to get and the more frustrated you’re likely to be. If you’re interested in an evaluation of your home as it currently stands, please reach out. I’d be happy to help!

As always, hope you have a great November and a wonderful Thanksgiving!

Brendan

Market Update - October 2022

The San Diego Real Estate market is moving and shaking but find out the 3 reasons why we’re not headed for a huge price decline AKA ‘Housing Crash’…

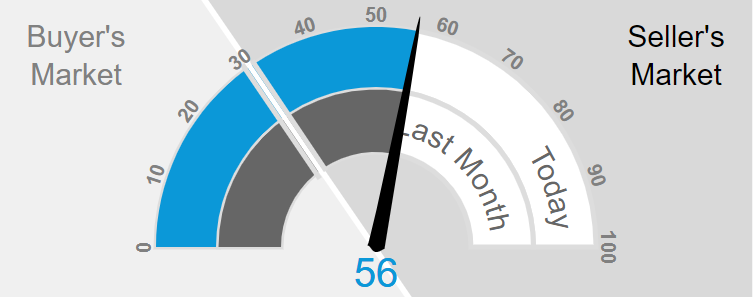

Chart 1 - Market Action Index - 56

Another month and more changes! The FED making the decision to increase their interest rates has had an effect consumer confidence and mortgage interest rates. We’re seeing all sorts of interesting dynamics at play! Speaking of mortgage interest, they rates have risen, on average, for 5 weeks straight. Some current buyers of mine that are in escrow thankfully locked their rate or they might have been priced out by the time we closed. The increased rates are having a huge impact on everyone including seller’s. Ultimately, I’m hopeful this will be positive long term as the housing market continues to get more balanced.

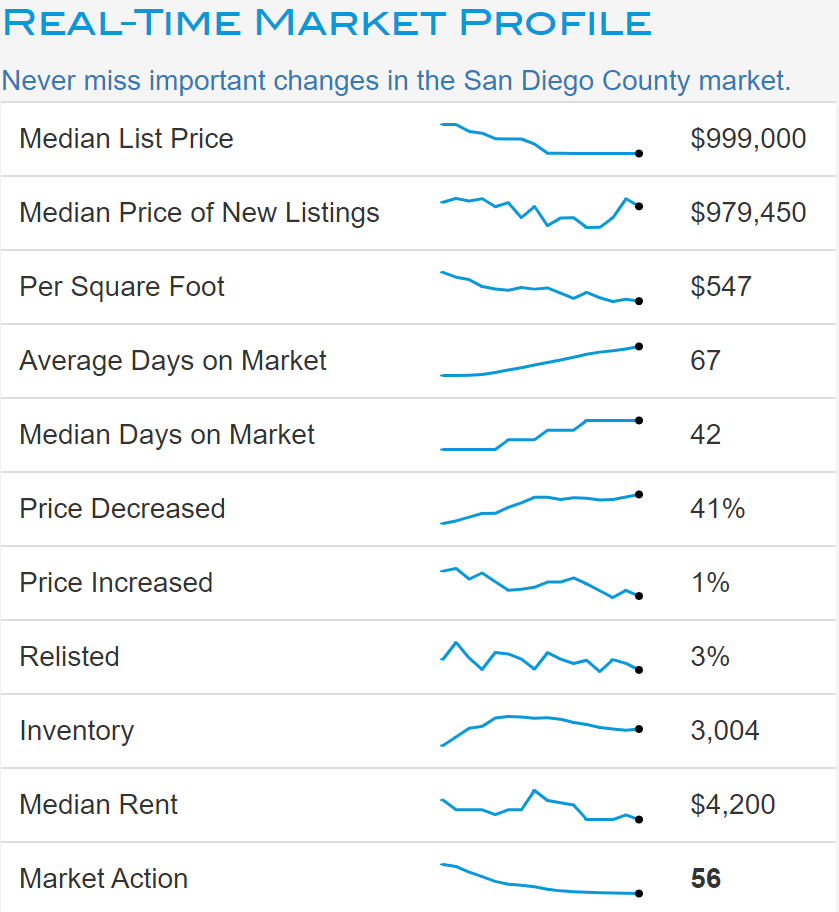

Chart 2 - Market Profile San Diego Single Family Homes

One thing that’s steady for now is median sale price of homes in San Diego. It’s still hovering just under $1M as you can see in Chart 2. The biggest changes continue to surround mortgage interest rates, days on the market, and buyer competition.

In general, days on market has shortened up a little as compared to last month. Overall, it still reflects normal market conditions. In fact, many of the market conditions remind me of the pre-pandemic market in 2018-2019. The affordability of homes has decreased since the beginning of the year. For example, on an $800K loan, it costs $1,600 more per month than it did 8 months ago. This is putting downward pressure on home prices and we’re starting to see some of those effects with price reductions. Ultimately, there’s opportunity in this market. If you’re a cash buyer that doesn’t have to worry about mortgage interest rates, a contingent buyer, or you’re a buyer who believes there will be a significant drop in rates in the coming years (like I do) then you’re in a great spot.

Here’s a couple tips regardless of whether you’re a buyer or seller in this market.

BUYER TIP: As a buyer in this market, one thing that would be an option is to negotiate a credit at closing from the seller in order to ‘buy down’ your rate. In other words, allow the seller to help you get a better mortgage interest rate to make it more affordable.

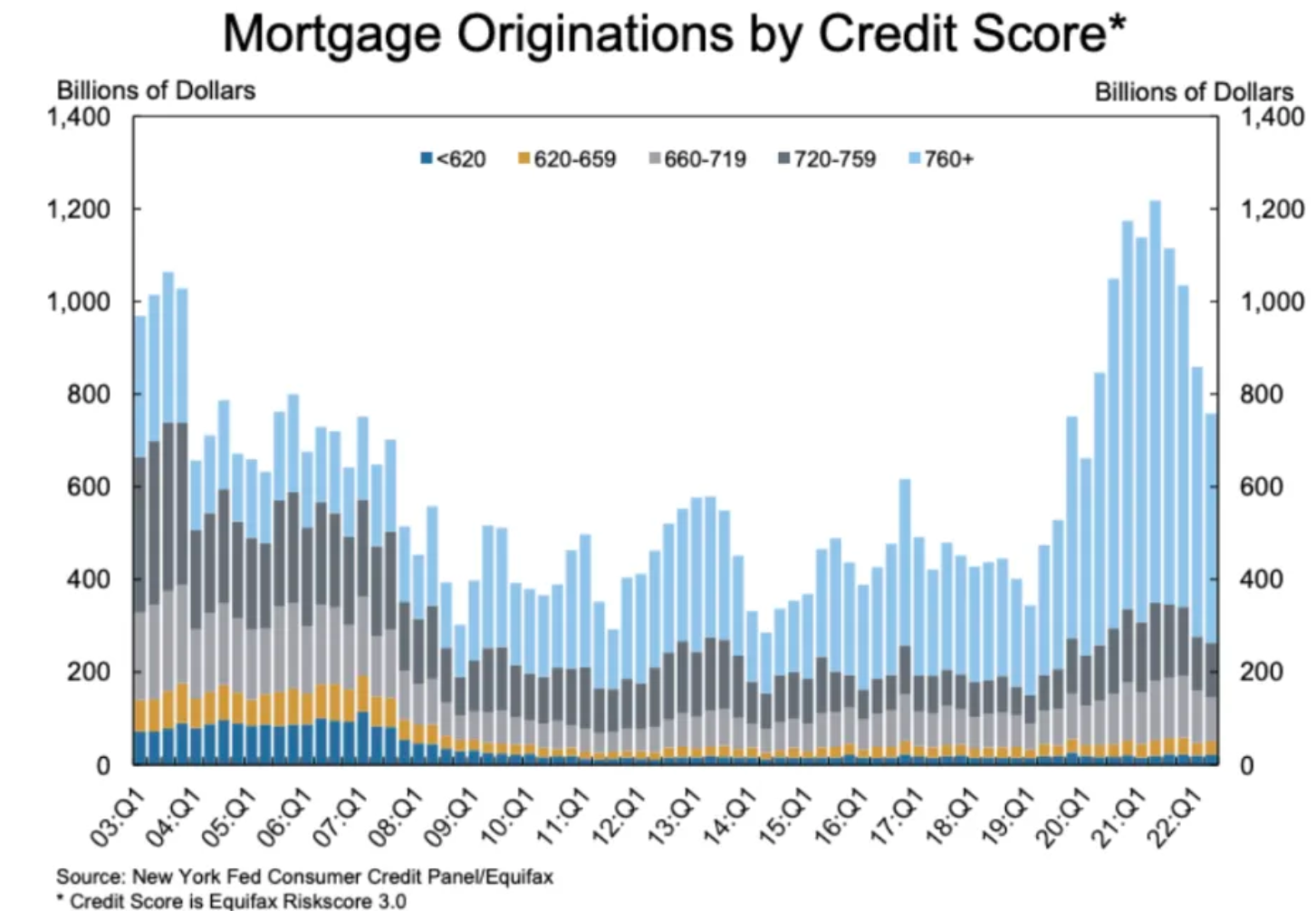

Chart 3 - Mortgage Originations by Credit Score

SELLER TIP: If you’re a current home owner, one option that might be worth talking about is a HELOC or Home Equity Loan. If you believe there’s going to be a dip in home values, now may be the best time to pull some equity out of your house. Many lenders have pivoted to promoting these loans because mortgages and refinances have dipped significantly as rates have increased.

As consumer confidence wanes, I thought I would share a few reasons why we’re likely NOT going to see a housing bubble pop like we did in the late 2000’s.

1. We have much more disciplined lending practices than previously before. A huge majority of mortgage originations go to borrowers with higher credit scores (Chart 3).

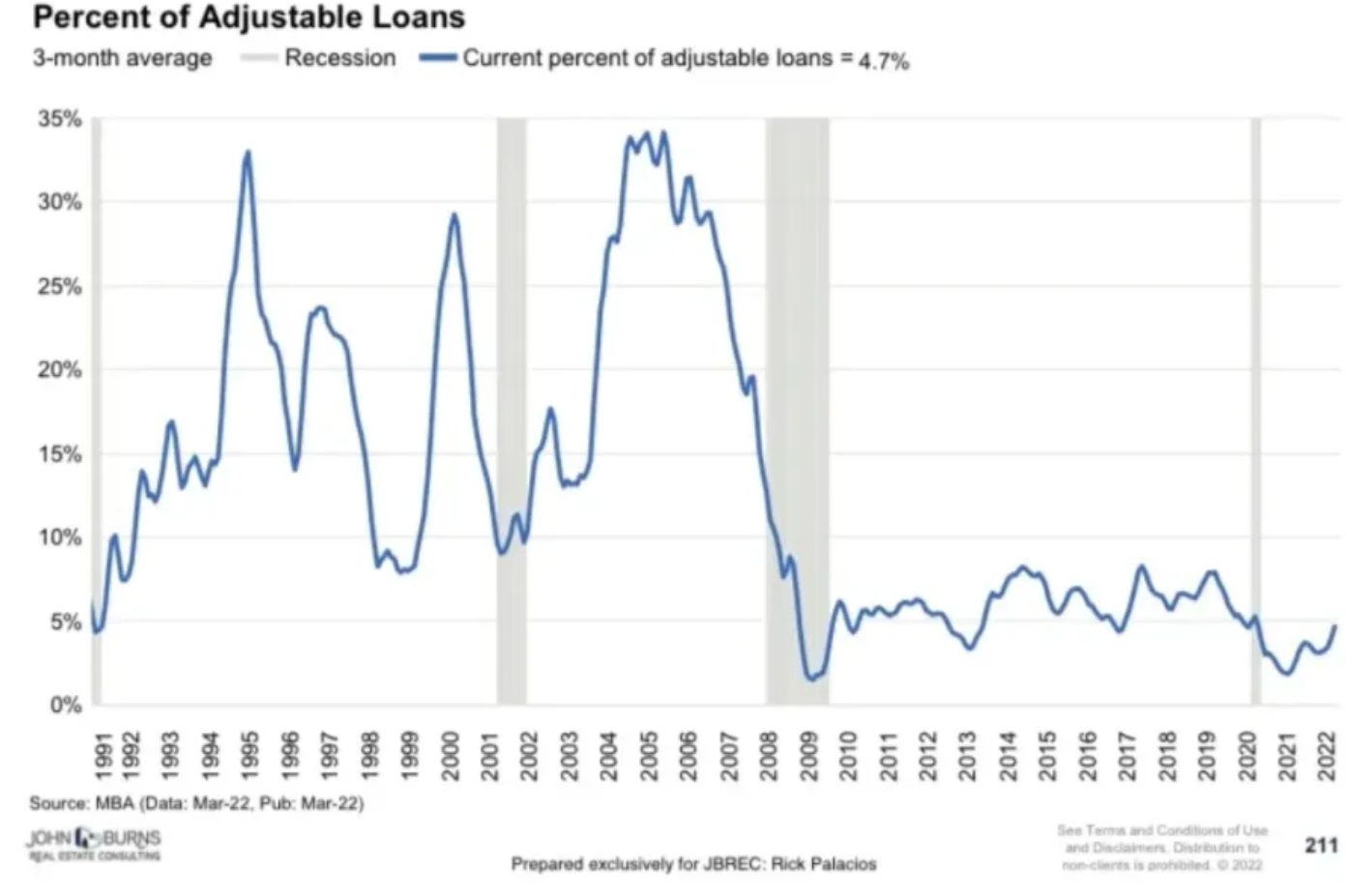

2. Interest rate volatility is minimized by the lack of adjustable rate mortgages. Most borrowers (roughly 95%) are opting for the security of a fixed rate mortgage (Chart 4).

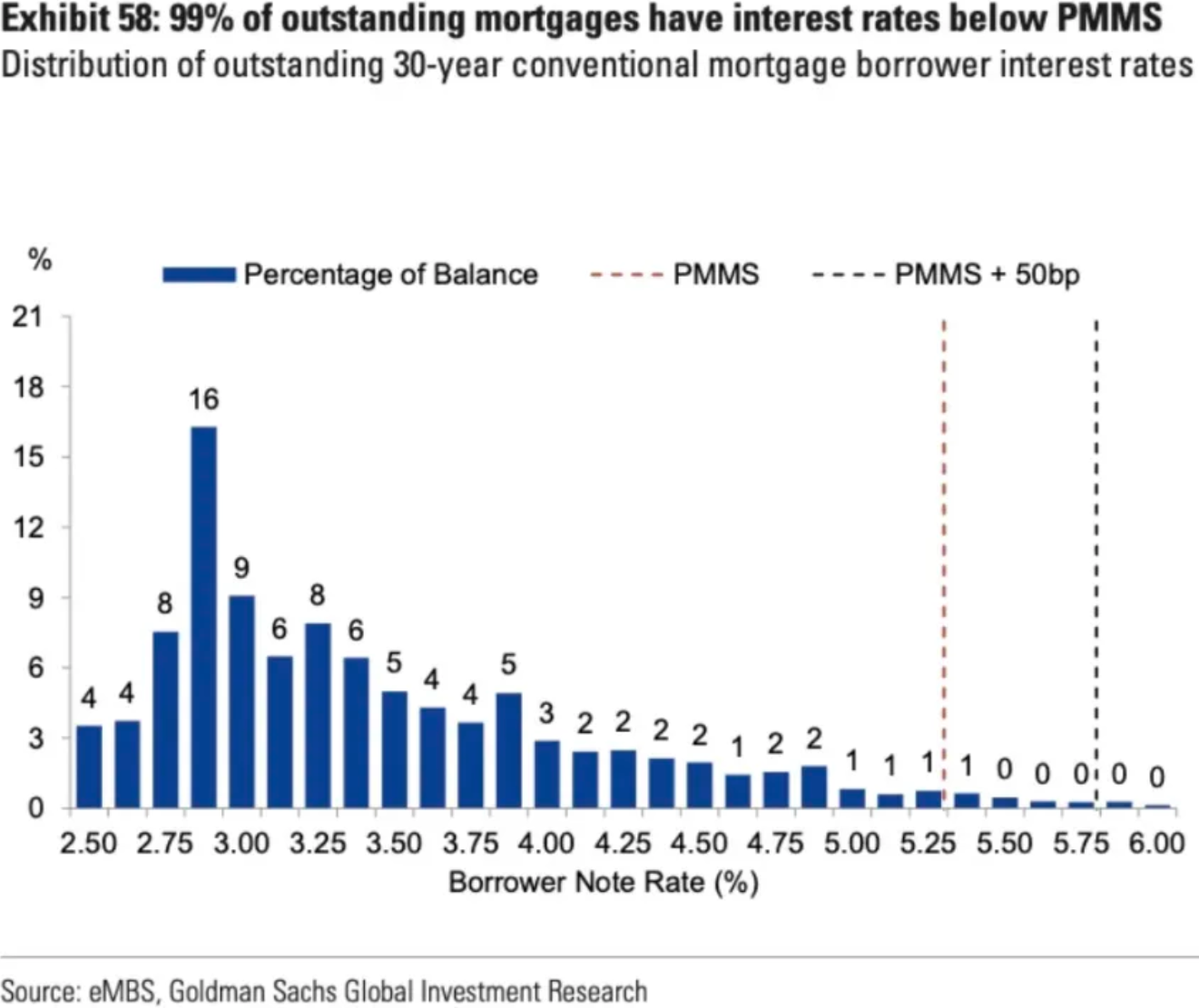

3. 99% of current mortgages have rates locked in less than the current market rate. A whopping 79% have rates less than 4% interest rates (Chart 5).

All of this is great news for everyone and our economy in general. Bright days for everyone ahead!

Chart 4 - % of Adjustable Rate Mortgages

Chart 5 - Current Mortgages by Interest Rate

As always, if I can help you in anyway please reach out!

Have a great October!

Market Update - September 2022

The Market Action Index (pictured) is the best snapshot I can give you of where we stand today. This is still considered a seller’s market but as you can see it continues to trend more towards the middle. I’ve done several open houses this past month which gives me a great opportunity to chat informally with many potential buyers that are shopping for homes. As a whole…

Market Action Index - 57

The Market Action Index (pictured) is the best snapshot I can give you of where we stand today. This is still considered a seller’s market but as you can see it continues to trend more towards the middle. I’ve done several open houses this past month which gives me a great opportunity to chat informally with many potential buyers that are shopping for homes. As a whole, buyers are feeling more reserved and seem to be likely to wait. It seems that many buyers who believe we’re going to see a ‘crash’ of sorts. I think we may be in the midst of an adjustment, but overall we’re not going to see anything that resembles a crash like we did in 2008. With that being said, I don’t think there is any reason for homeowners to panic sell. There’s still limited inventory and lending practices have improved drastically and legislated out since the issues in 2008.

Where we might see a bigger price adjustment is IF job losses increase. Chart 1 shows the data regarding unemployment as of today. California posted its lowest unemployment ever at 3.9%. Of course, the type and quality of jobs that people are employed in is up for debate. In summary, we likely won’t see a major price crash because people are employed, home inventory is still low, and risky loans that could force a homeowner to sell are practically non-existent.

Chart 1 - Unemployment Rate, July 2019 - 2022

Chart 2 - Market Profile San Diego Single Family Homes

Mortgage interest rates are always a big point to note as they directly affect affordability. While it’s true that the higher the interest rate, the more you’ll pay in interest over the life of the loan, the bigger issue for most borrowers is Debt to Income (DTI) ratio. This is determined using gross monthly income and debt payments due each month. As homes have gotten more expensive in San Diego, DTI has been exceptionally important as most loans won’t be approved with more than 50% DTI.

While the FED met on Friday 8/26 and decided not to raise the interest rates, their comments caused some volitility. As of today, avg. 30 year fixed rate is 5.95%. While the two rates (FED and Mortgage interest rates) are linked, they do act independently based on other factors in the markets. For example, loan mortgage originators have dropped rates after the FED has raised rates the last two months. The reason is purchase applications are down and they’re trying to generate loan business.

If you’re a buyer, but still have not updated your pre-approval it would be a great time to do so considering how much rates have changed over the past 8 months. I’d be happy to connect you to a few different mortgage brokers to have it updated!

Median List Prices have dropped below $1M from $1.05M last month (chart 2). Three major data points continue to hover including 1. median list price, 2. inventory, and 3. % of listings that have decreased their price. These figures all closely resemble each other from one month ago. One that has had a sizable jump in the last month is Median Days on Market which has gone from 21 days to 35 days.

Even as we trend more toward a buyer’s market, it’s still a good time to sell! This is especially true if you’re looking to be a contingent buyer – meaning you’d be making an offer on a house contingent on selling your current home. Contingent offers haven’t been considered in the last few years due to the demand, so sellers that have wanted to buy a replacement home haven’t had the option. NOW is your time!

Additionally, buyers who know what they want have a true opportunity to get into a house without many of the restrictions they’ve faced in the previous 3 years. This market isn’t a good fit for everyone, but WOW is there tons of opportunity out there. Reach out so we can discuss if it’s a good time for you to buy or sell. Have a great September!

Market Update - August 2022

I believe a visual representation is the best way to give you an update on the market. It will give you a good ideas of what has been happening over time. As soon as someone starts talking about year over year percentages, my eyes start to glaze over (that’s usually when I pour myself another cup of coffee)…

I believe a visual representation is the best way to give you an update on the market. It will give you a good ideas of what has been happening over time. At least for me as soon as someone starts talking about year over year percentages, my eyes start to glaze over (that’s usually when I pour myself another cup of coffee).

If you’re in the market to buy or sell, I hope you’ll reach out with questions so we can talk specifics. With that being said, this is general information that I hope you’ll find helpful.

As of right now, it’s still a pretty strong seller’s market based on inventory and prices. However, we have started to see some changes over the last couple of months (also, let’s be honest… it’s almost always a seller’s market in San Diego). It’s true - there’s more inventory than there has been since January 2020, but that doesn’t mean there’s a lot of inventory. Homes for sale are sitting on the market longer and pricing is starting to flatline, if not decrease. There’s no doubt this is the friendliest market for buyer’s we’ve seen in the last 2.5 years! Especially after mortgage interest rates dropped again late last week. If you’ve been waiting to buy, NOW could be your time.

This market segments table gives tons of perspective to the data. The data on the market overall is useful, but breaking it down into four segments really clarifies things for most homeowners. You are most likely going to look at 1-2 of these segments. You’re either considering upsizing, downsizing, or you’re potentially sitting between two segments.

Most of the conversation revolves around how much interest rates have increased since the beginning of the year. While it’s true that the rates have roughly doubled, it’s also true that we’ve had a small decrease recently. Last week, we hit a 34-day low for interest rates. And after the Federal Reserve met last week, rates have dropped significantly. Mortgage interest rates as of today are 5.05% on average for a 30 year fixed conventional loan. From a historical perspective, these are not the highest interest rates we’ve seen. The rates were double digits back in the 80’s (median home prices also weren’t $1M though). The rate increase does make your payment more expensive, but the biggest kicker is your debt to income (DTI) ratio. If your DTI exceeds 50%, then it’s going to be highly unlikely you’ll qualify for a loan. These stricter lending rules were put in place after the subprime mortgage crisis in the late 2000’s.

According to the Mortgage Bankers Association (MBA), a weak economic outlook, high inflation, and affordability has decreased buyer demand. That has led to the drop in purchases and refinance applications.

Figure 4

Builder confidence is also down as they continue to deal with supply chain issues, inflation, rising costs of goods, and decreased buyer demand. You can see in the graph (Fig.4) that single family home construction is trending down. Fewer home construction ‘starts’ means they’re beginning to have big concers about where the market is headed. The demand is decreasing since many buyers are getting priced out by rising rates. The last thing builders want is to have a surplus of homes with no buyers. Bottom line: builders can’t sell a home for less than it cost to build.

Last but certainly not least, the cost of renting continues to trend in the upward direction. It’s interesting to note that even during a recession rent increased, sometimes dramatically. All that to say, it’s still a good time to be in the market whether you’re a buyer or a seller. However, even though it’s still a seller’s market this is the best opportunity to buy in the last 2.5 years!

There are plenty of options and I’d love to discuss what’s best for you and your family.