Market Update - January 2023

Market Action Index - January 2023

December in Real Estate is traditionally one of the quietest times of the year. Most of us are ready for a break and ready to spend time with family enjoying the festivities. It leads to a little bit of a lull as we shift into the new year. For many, buying a house and packing up everything you own isn’t on your holiday agenda. However, because it’s slow means there’s opportunity for both buyers and sellers.

“Most of what happens in the real estate market is predicated based on what happens in the economy. Two big indicators to keep an eye on: inflation and jobs.”

Market Profile - January 2023

Buyers are waiting for more inventory to help alleviate price increases and sellers are worried they won’t be able to buy a replacement property. This is why I’ve been telling my sellers this is the best time to make contingent offers on your next home. It allows you to sell with confidence as you know where your next home will be!

Inventory dropped off dramatically, from low to really low! In fact, we saw the index swing higher toward a sellers market. As a result we saw an increase in median price by over $1M. This isn’t purely a pricing surge based on inventory levels, but it is an indicator that higher luxury priced homes are more likely to stay on the market longer and more likely to be immune to the seasons of real estate.

Looking forward to 2023, the consensus is that home prices will continue to drift down as more inventory comes back on the market and starts to normalize.

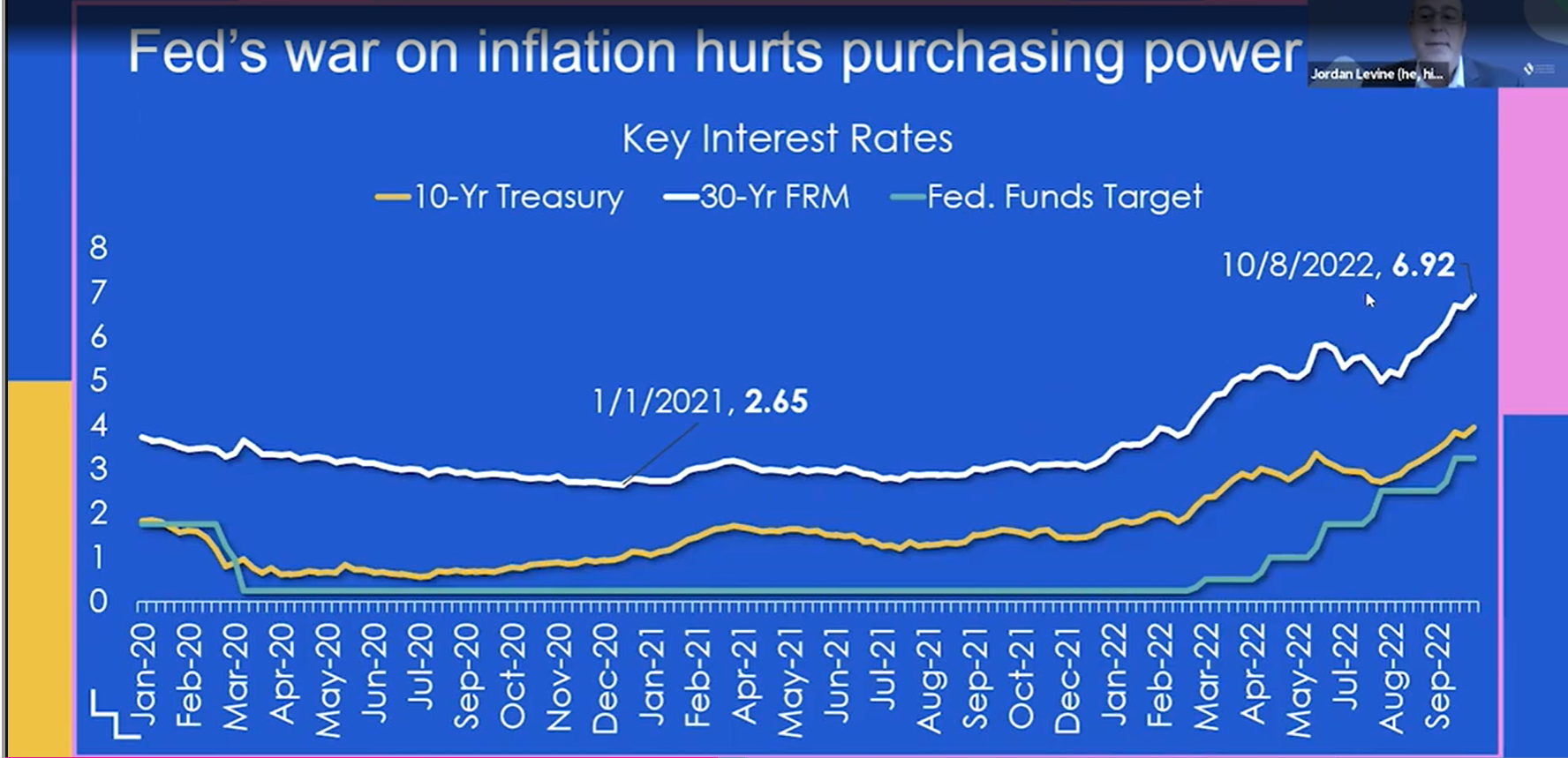

Most of what happens in the real estate market is predicated based on what happens in the economy. Two big indicators to keep an eye on: inflation and jobs. If inflation rates don’t subside neither will mortgage interest rates. This will make borrowing money more expensive and narrow the pool of potential buyers. If we see a decrease in rates, it will likely reignite the real estate market. Some buyers will feel pressure to take advantage of a lower rate. As far as job reports go, it really comes down to supply. Inventory is incredibly and historically low. One way we’d see an increase is if there’s an uptick in distressed selling - I.e. homeowners need to sell because they lost their job and can’t pay their mortgage.

As I have mentioned in this space before we are not primed for a crash, this is more of a correction in regard to what has transpired over the past two years. Depending on how jobs and inflation rates trend, we may even see a buyers market toward the end of 2023. No one really knows what will happen that far out, but it’s important for you to stay up to date with these reports so you’re informed as things change.

The FED has increased interest rates over 400 basis points in the past year. No one ever wants to hear this word again, but that dramatic of an increase is ‘unprecedented’. The reason for the increase is the FED’s continued effort to curb inflationary rates. While I believe increases are necessary, I’m concerned that it’s an overswing and it hugely impacts the economy. Additional aggressive increases could put the economy into a tailspin. The real litmus test is asking yourself how likely are you to make a big purchase right now? Gut feeling? My guess is you might be feeling hesistant at best and that’s a real indicator for where most of middle class America stands. The graph on the ‘Fed’s War on Inflation’ below gives a good idea of how all of these rates are linked to each other, most importantly as related to real estate, 30-year fixed mortgage interest rates.

Fed’s War on Inflation - January 2023

As always, if you know someone looking to buy or sell their home, I would love to connect with them and would be eternally grateful for the faith you have in me.

I hope you and your family have a wonderful beginning to the new year. Here’s to health and happiness in 2023!

Brendan