Market Update - October 2022

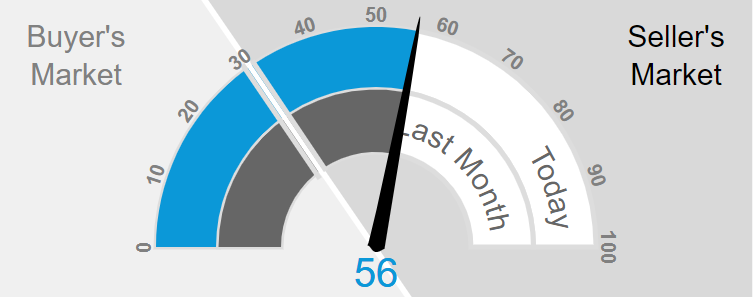

Chart 1 - Market Action Index - 56

Another month and more changes! The FED making the decision to increase their interest rates has had an effect consumer confidence and mortgage interest rates. We’re seeing all sorts of interesting dynamics at play! Speaking of mortgage interest, they rates have risen, on average, for 5 weeks straight. Some current buyers of mine that are in escrow thankfully locked their rate or they might have been priced out by the time we closed. The increased rates are having a huge impact on everyone including seller’s. Ultimately, I’m hopeful this will be positive long term as the housing market continues to get more balanced.

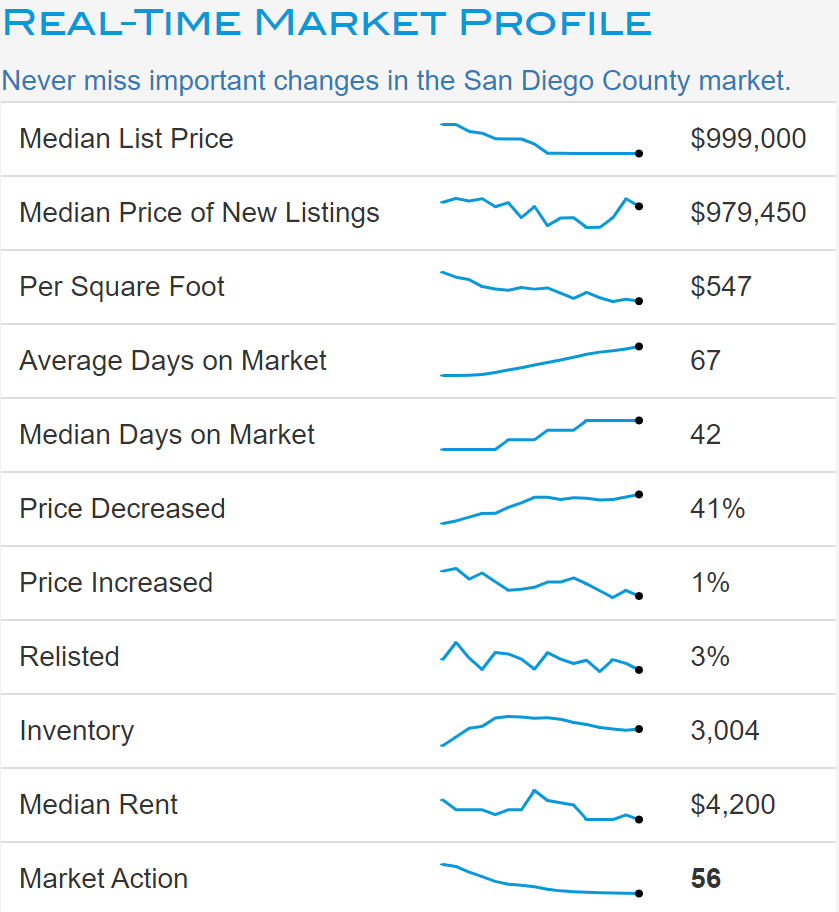

Chart 2 - Market Profile San Diego Single Family Homes

One thing that’s steady for now is median sale price of homes in San Diego. It’s still hovering just under $1M as you can see in Chart 2. The biggest changes continue to surround mortgage interest rates, days on the market, and buyer competition.

In general, days on market has shortened up a little as compared to last month. Overall, it still reflects normal market conditions. In fact, many of the market conditions remind me of the pre-pandemic market in 2018-2019. The affordability of homes has decreased since the beginning of the year. For example, on an $800K loan, it costs $1,600 more per month than it did 8 months ago. This is putting downward pressure on home prices and we’re starting to see some of those effects with price reductions. Ultimately, there’s opportunity in this market. If you’re a cash buyer that doesn’t have to worry about mortgage interest rates, a contingent buyer, or you’re a buyer who believes there will be a significant drop in rates in the coming years (like I do) then you’re in a great spot.

Here’s a couple tips regardless of whether you’re a buyer or seller in this market.

BUYER TIP: As a buyer in this market, one thing that would be an option is to negotiate a credit at closing from the seller in order to ‘buy down’ your rate. In other words, allow the seller to help you get a better mortgage interest rate to make it more affordable.

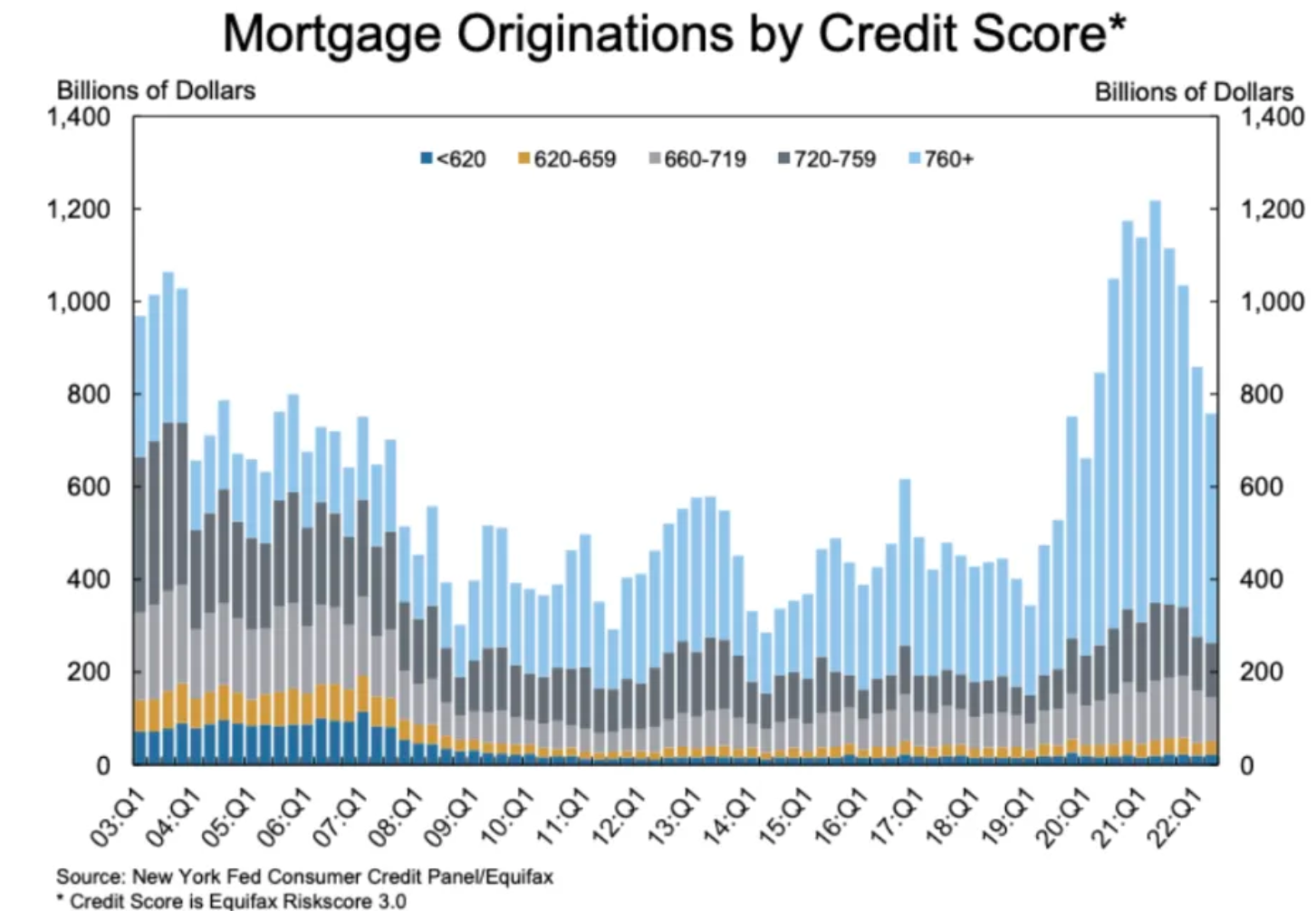

Chart 3 - Mortgage Originations by Credit Score

SELLER TIP: If you’re a current home owner, one option that might be worth talking about is a HELOC or Home Equity Loan. If you believe there’s going to be a dip in home values, now may be the best time to pull some equity out of your house. Many lenders have pivoted to promoting these loans because mortgages and refinances have dipped significantly as rates have increased.

As consumer confidence wanes, I thought I would share a few reasons why we’re likely NOT going to see a housing bubble pop like we did in the late 2000’s.

1. We have much more disciplined lending practices than previously before. A huge majority of mortgage originations go to borrowers with higher credit scores (Chart 3).

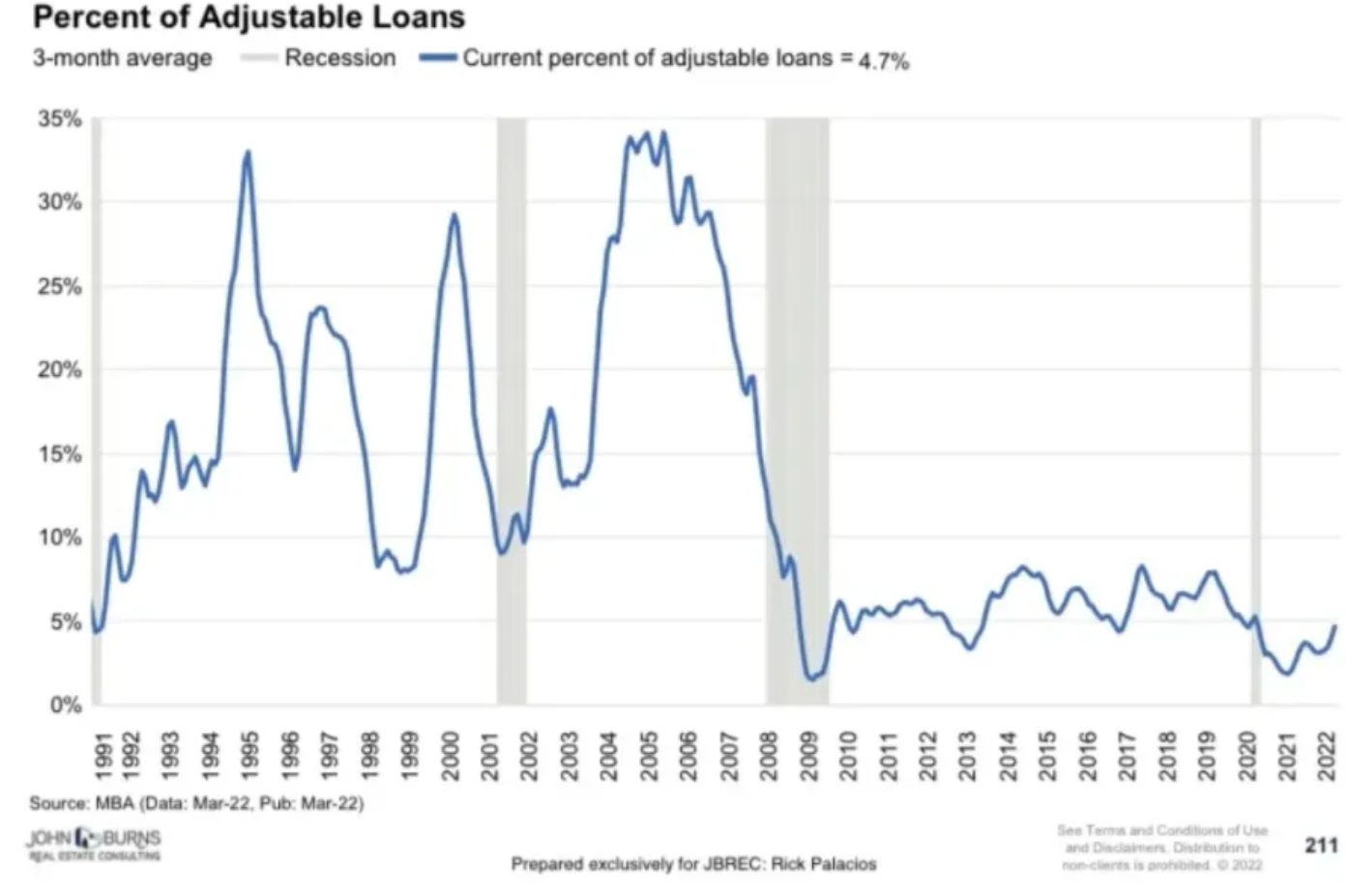

2. Interest rate volatility is minimized by the lack of adjustable rate mortgages. Most borrowers (roughly 95%) are opting for the security of a fixed rate mortgage (Chart 4).

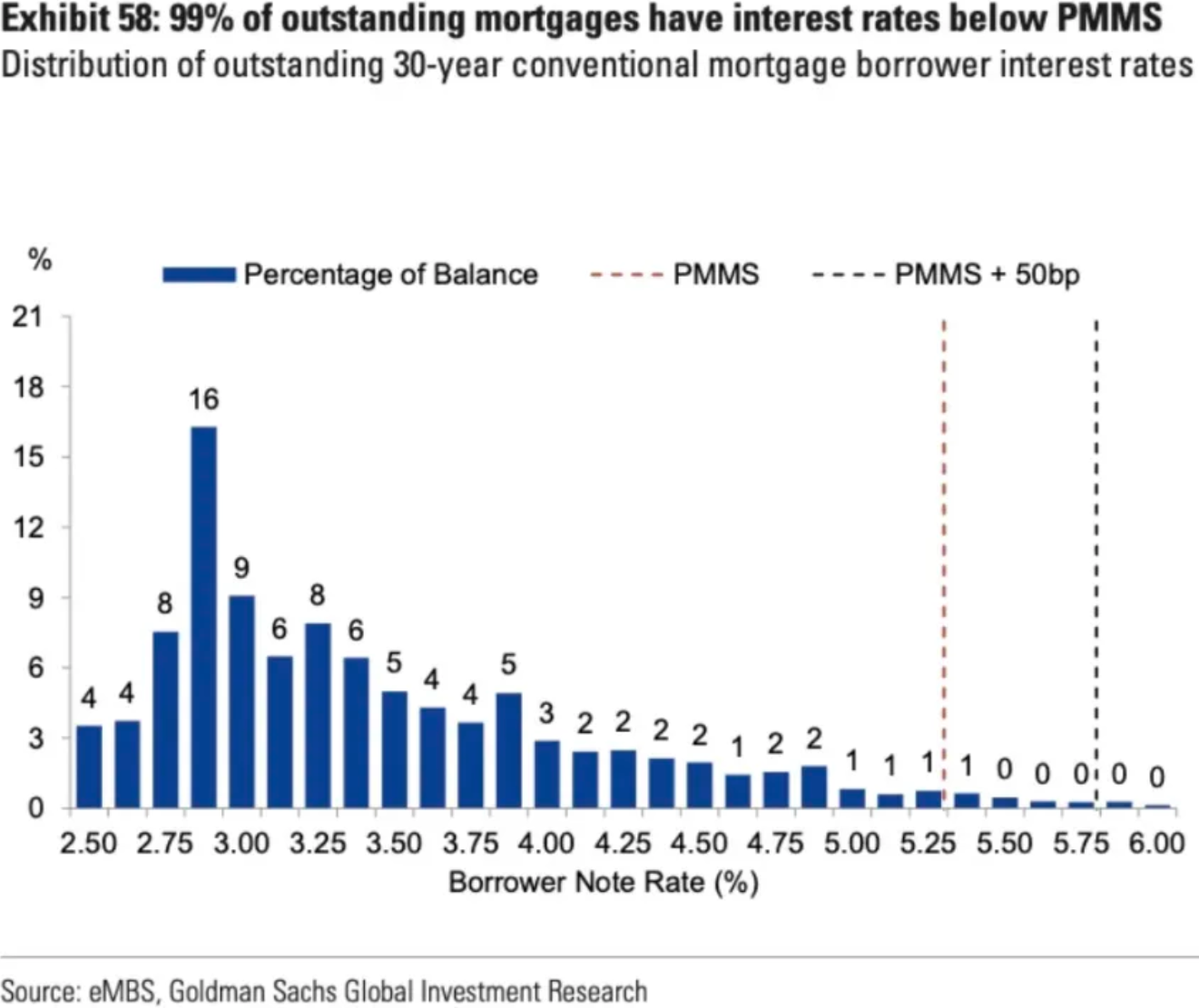

3. 99% of current mortgages have rates locked in less than the current market rate. A whopping 79% have rates less than 4% interest rates (Chart 5).

All of this is great news for everyone and our economy in general. Bright days for everyone ahead!

Chart 4 - % of Adjustable Rate Mortgages

Chart 5 - Current Mortgages by Interest Rate

As always, if I can help you in anyway please reach out!

Have a great October!