Market Update - June 2023

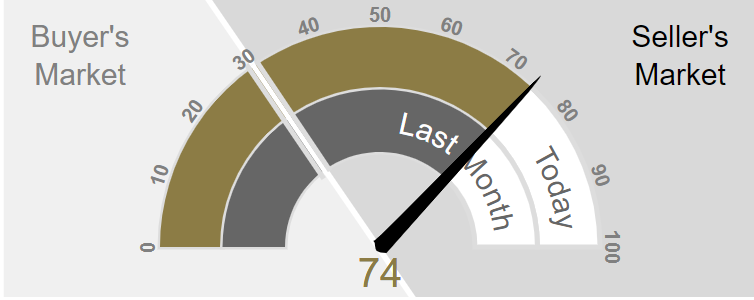

Market Action Index - June 2023

San Diego tends to be in a perpetual state that favors sellers over buyers. The only question lately is how much of a seller’s market is it? More than it has been since last June when the market was absolutely at its peak. Starting in July of ‘22, home prices started to track down as interest prices rose. That continued until March ‘23 where we started seeing interest rates settle in the 6’s.

Buyer demand has remained high and once you take a big GULP and swallowed the fact that interest rates have doubled - home prices have started to head north again.

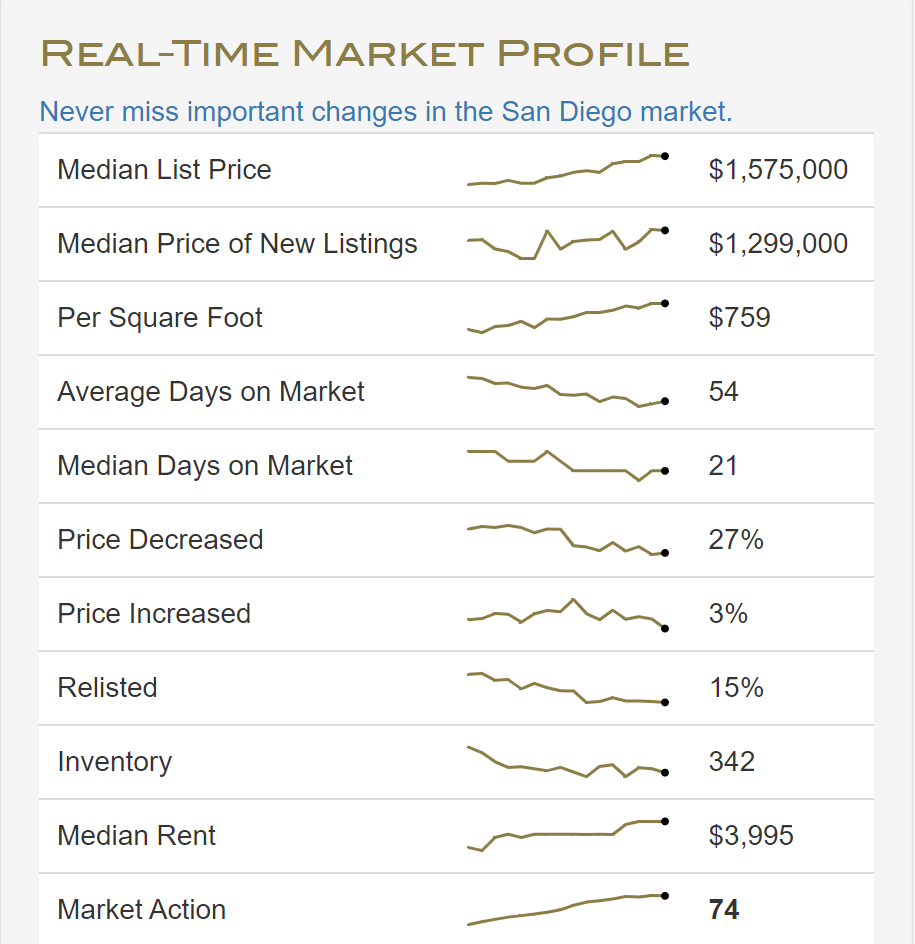

Market Profile - June 2023

Home prices have really taken a large leap in the past month with median home list prices up almost ~$175K. They jumped from $1.349M to $1.575M in a month… I’ll let that wash over you. I hate to tell you that I’ve been telling you this for months, wait no actually I love telling you I was right about this ;) What I don’t like is how sticky the market has continued to be. I have to say, I don’t blame anyone for holding off on any major decisions, which includes buying or selling your home. Inventory and days on market are tracking down and most reasonable (both in price and quality) homes are in very competitive bidding wars. If you want to buy a home right now, you likely need to be aggressive in your offer both in terms and price. You DEFINITELY need to have a great agent who will put all of your ducks in a row. And of course, you need to pray to the San Diego housing Gods, wear your lucky socks, and run around at an aviary hoping a bird poops on you for luck… kidding… kind of.

“Owning a home in San Diego has become tougher in the past decade. In 2020, the homeownership rate fell from 54.4% to 53.5%, the lowest in 40 years.”

Home Prices on the Rise -June 2023 (Figure 1)

All of home price value that was lost between July ‘22 and February ‘23 has now been recovered (Figure 1). The real question continues to be what will happen with interest rates? We need them to come down to loosen up this market. I’m predicting once they start to come down, prices are going to jump higher and higher until current homeowners that are thinking of selling can’t ignore the cash out any longer. On top of the fact they may be able to stomach a rate in the 5’s if they want to buy a replacement property.

Employment is going to play a big part in interest rates, because it’s so directly related to inflation and distressed selling. It’s been a confusing stretch when it comes to jobs. Employers added 339,000 jobs in May, all while various well-known companies including Facebook, Google, McDonalds, Walmart, Microsoft and Goldman Sachs are cutting/or have cut jobs. Additionally, unemployment is up to 3.7% which is the highest it’s been since October - although historically still very low.

Keep a close eye on the consumer price index which is how we measure inflation. As that number decreases, so will mortgage rates. If it shows signs of an increase or stagnation, we’re going to see the FED raise interest rates again. The FED is dead set on squashing inflation, even if it puts us into a full-fledged recession.

HOT TOPICS

Mortgage rates dip slightly as debt ceiling crisis is avoided - The Freddie Mac survey just came out, and it looks like the average 30-year fixed rate mortgage went up to 6.79% for the week ending June 1, 2023. Here's the good news: thanks to progress on the debt ceiling agreement, the daily mortgage rates dropped from 7.14% earlier in the week to the high-6s again. New mortgage applications are still declining, but not by as much as before. The purchase index is still low, and homebuyer demand is expected to stay below pre-pandemic levels. That's because rates will likely remain in the 6-7% range until inflation goes down.

Exceptionally strong jobs report keeps pressure on the Fed - Even though the Fed has been trying hard to slow down the overall economy by increasing interest rates aggressively, the job market is still doing better than expected. In May, the U.S. economy added a whopping 339,000 new jobs, which was way more than what experts predicted. This shows that the labor shortage, which started during the pandemic is still a big issue. People are eagerly waiting to see if they'll raise rates once more at their meeting on June 13-14.

Consumer confidence slipping despite strong jobs data - Even though more jobs were created in May, people are starting to worry about their future job prospects. Consumer confidence, as a whole, went down a bit in May, but not by much. However, fewer people are saying that job opportunities are "plentiful," and few are quitting their jobs compared to even before the pandemic hit. As jobs become less easy to find, it might help ease inflation, but it also means that wages won't be growing as much. Along with less savings, increasing credit card debt, and stricter credit standards, this could lead to consumers taking a step back despite being the main force driving economic growth for the past three years. In fact, people's plans to buy expensive things in the near future were down across the board in May.

Fast Tracking Permits in unincorporated areas - The San Diego County Supervisors just gave the thumbs up to some new rules that will make it easier to build houses in unincorporated areas. It's hard to say exactly how much this will actually speed up home construction. In 2022, only 1,667 homes were built in unincorporated parts of the county, which is a measly 17 percent. Environmentalists are vocal about not building in the backcountry. They're worried about things like car pollution, the risk of fires, and other factors. And you know what? Judges often side with the environmentalists in lawsuits. Just last October, they put the brakes on a project to build 1,119 homes east of Chula Vista because of these concerns.

San Diego Homeownership rates vs. other counties in the state (2020).

In the last ten years, the dream of owning a home in San Diego has become even harder to achieve. The crazy high prices of houses have wiped away any progress that hopeful buyers made after the Great Recession. In 2020, the percentage of households who owned a home dropped from 54.4 percent a decade ago to 53.5 percent. That's the lowest it's been in forty years.

All that being said, if you’re considering buying or selling, please give me a call and let’s talk about if it makes sense to do it sooner rather than later.

Will sunshine come at any point this year??! I’m sure we’ll be complaining it’s too hot soon enough :)

P.S. I live on referrals (and will love you forever) if you send someone my way. It’s among the greatest compliments I can receive. I will treat them like family. Thank you in advance!

Brendan