Market Update - January 2024

Market Action Index - January 2024

Happy New Year! The calm before the storm, the lag effect, tranquility before chaos, silence before all hell breaks loose… however you want to say it. We’re there. A lot of people in the industry are talking about how quiet it is right now. We’re in the holding pattern, but come March 1st, LOOK OUT. It’s going to be ON. There are a number of buyers and sellers watching rates like a hawk. The FED has promised rate cuts as we dive into 2024 and for buyers it’s a blessing in an attempt to make buying a home affordable again. Sellers that are looking to sell their current property and move into another property are also watching to see if those interest rates gets into the 5’s or maybe even the 4’s. Keep an eye on the data; it will tell the story. Inflation, job reports, and 10 year treasury yield… I’m confident we’re going to see more transactions this year. This is what happens in a healthy market! Let’s see (and hope) if I’m right. Cheers to 2024!

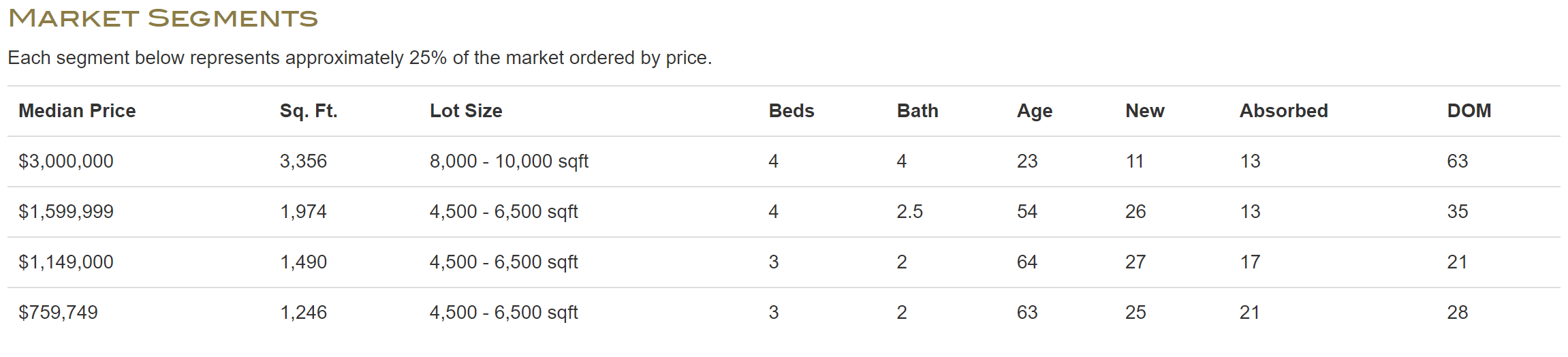

Market Segments - January 2024

“Empty-nest baby boomers own 28.2% of the three-bedroom-plus homes in the country, while millennials with children own just 14.2%.

This disparity comes even as more millennials (28%) than baby boomers (27%), make up the adult population of the U.S.”

Market Profile - January 2024

HOT TOPICS

Would you like a free home report every month? If you’d like a free home report every month, all I need is your home address and a good email for you. I’ve been getting great feedback from everyone who is getting them. It’s a great way to track home values, loan information, payoff ideas, and what you might be able to rent your home for. Send me an email to brendan@vshometeam.com to be added!

Small business optimism closed the year on a high note - The NFIB index, a gauge of U.S. small business sentiment, increased by 1.3 points to 91.9 in December. This marked the first uptick in five months, tying the 2023 high from July. The economy's resilience boosted business outlook, driving optimism upward at the year's end. Although sales expectations improved in December, they still stayed in negative territory. Inflation posed the main challenge for small businesses last month, while hiring remained difficult for many owners. The index is below the historical average for the 24th consecutive month.

Inflation climbed more than expected in December - Consumer prices rising 0.3% month-over-month and 3.4% year-over-year. Economists were anticipating a 3.2% increase in the Consumer Price Index (CPI) for the month, slightly up. The boost in overall prices was mainly driven by a 6.2% year-over-year increase in shelter costs. Core CPI, excluding food and energy, dropped to 3.9% in December from November's 4%, marking the first time in two and a half years it fell below the 4% threshold. Despite a slight rise in headline CPI, inflation is gradually easing, but the downward trend is slow. Looking ahead, the expectation is for further decline, with the headline CPI likely dropping below 3% year-over-year by the end of 2024.

Mortgage rates edged up in the second week of 2024 - AKA the Highest level in three weeks. This uptick is partly due to positive economic data and some uncertainty about the Fed's future rate cuts. However, recent data suggests a turnaround as fresh inflation reports keep hopes for low rates alive. With CPI slightly higher than expected, rates may experience some volatility in the weeks ahead. Despite this, lower rates at the beginning of the year led to a 9.9% week-over-week surge in mortgage applications, bringing some homebuyers back into the market, according to the Mortgage Bankers Association.

Foreclosures in the U.S. went up in 2023 - reaching 357,062, a 10% increase from 2022 but still 28% lower than 2019 levels, says ATTOM. Despite the bump, foreclosure activity remains well below the Great Recession peak, dropping 88% from 2010. These filings accounted for 0.26% of all U.S. housing units, a slight rise from 2022 but a decrease from 2019 and a significant drop from the peak in 2010. With expected home price increases and a mild economic growth in 2024, foreclosure activity may fluctuate but is not anticipated to sharply rise in the next year.

If you need that PUSH, this is it. You need a plan even if you don’t have your stuff together. Call me and let’s make your vision come true!

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!