Market Update - February 2024

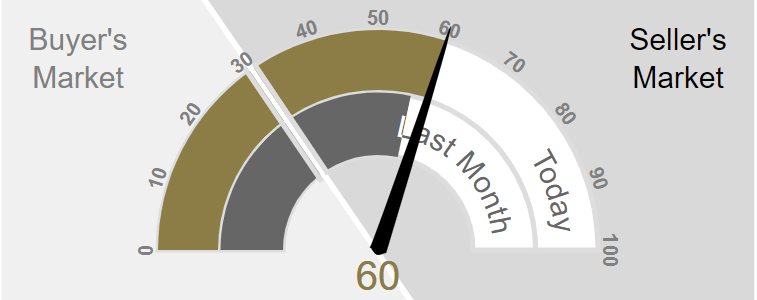

Market Action Index - February 2024

Well, as always, an interesting start to the year. My passion for this topic aside, it’s going to be an FASCINATING year. First, home buying activity is up, but I would say more ‘shoppers’ than buyers right now. Affordability is still brutal and about to get worse with prices rising. The FED has remained hawkish on rate cuts. As a result, even though rates have dropped since late last year, MOST of us in the industry were hoping for more positive movement by now. It will remain to be seen if we have somewhat of a ‘late’ seasonal surge. That’s my prediction for now. Overall, if you’re a buyer you MUST be prepared to be aggressive in whichever segment of the market your buying in. And, aggressive doesn’t mean reckless.

However, you need to know what you want and what calculated risks you’re willing to take. The strategy is the fun part, feel free to reach out and ask how I get my buyers into homes with minimal risks. As a seller, you again find yourself in great territory with many sellers being able to call the shots. However, pricing and presentation still remains incredibly important and can cost you serious cash if not handled the right way. Why does January seem so long and February seem so short, other than the obvious (2-3 days)?? Spring is almost here!

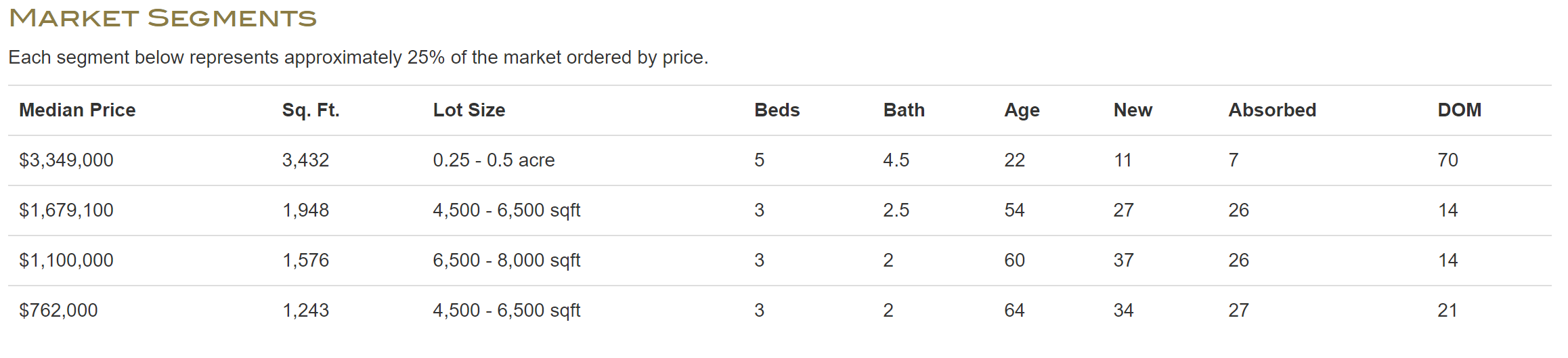

Market Segments - February 2024

“Evidence of this heightened competitiveness is clear: homes are selling faster than ever before, with the median time on market plummeting from 42 days in 2023 to just 20 days last week. ”

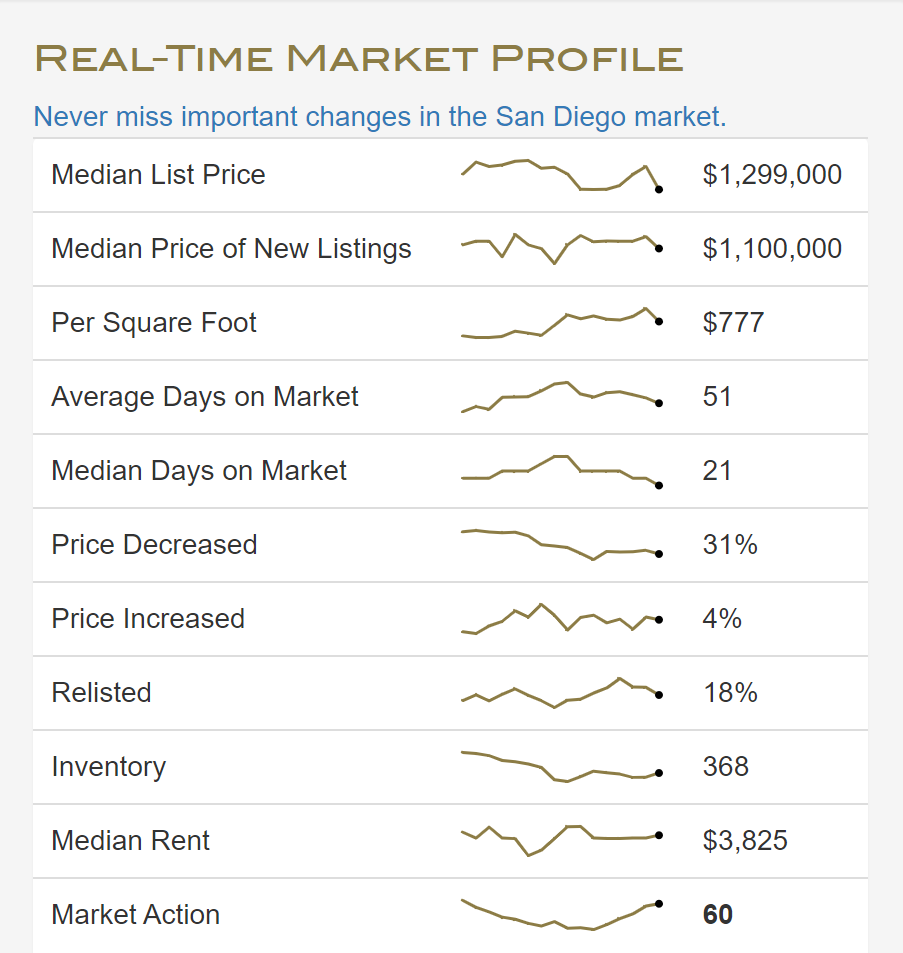

Market Profile - February 2024

HOT TOPICS

Would you like a free home report every month? If you’d like a free home report every month, all I need is your home address and a good email for you. I’ve been getting great feedback from everyone who is getting them. It’s a great way to track home values, loan information, payoff ideas, and what you might be able to rent your home for. Send me an email to brendan@vshometeam.com to be added!

Market competitiveness ramps up - With inventory levels at historic lows, buyers are facing increased competition even before the traditional Spring homebuying season begins. Evidence of this heightened competitiveness is clear: homes are selling faster than ever before, with the median time on market plummeting from 42 days in 2023 to just 20 days last week. Furthermore, the trend of homes selling above list price is on the rise, with nearly half of all closed sales achieving this feat last week alone.

Rates comes down slightly - Last week, average consumer rates saw a slight dip, easing from 6.9% to 6.77%. However, despite this decline, daily rates quoted in the marketplace remain above 7%. Economic indicators suggest that rates may not decrease rapidly, with forecasts pushing potential Fed rate cuts to the second half of the year. As a result, some prospective homebuyers may choose to enter the market sooner and consider refinancing later, rather than waiting for anticipated rate drops.

What crash? - Good news for California homeowners: the majority are keeping up with payments and have substantial home equity. With only 2.5% of mortgages delinquent, nearly 98% of homeowners are meeting their payment obligations. Additionally, almost all homeowners in California have at least 20% equity in their homes. Even in a worst-case scenario of a price correction, most homeowners would still retain positive equity, minimizing the risk of distressed sales in the event of an economic downturn. There remains no data to support an oncoming crash of home prices.

Things are heating up, if buying or selling has crossed your mind. Let’s chat.

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!