Market Update - December 2023

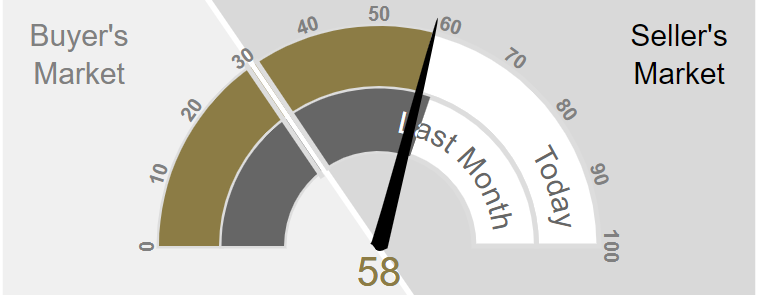

Market Action Index - December 2023

Let’s be honest, December is really an opportunity to look forward to 2024. 2023 had the lowest number of homes sold in decades. It’s been a tough market for both buyers and sellers, despite it still being advantageous to be a seller in San Diego (maybe for eternity??). We’ve had sellers who would like to sell, but feel locked in by their current mortgage rate. Then there’s the buyers… sigh. Inventory was down, prices AND interest rates were up. It’s been a rough go in 2023, but things look to be improving as we race down the stretch to 2024. Currently, we’re seeing home prices stay the same or increase, but we’re also seeing days on market increase. It’s harder to sell homes right now than it has been in the past 2.5 years. Until we saw a slight decrease in interest rates, new buyers had had enough and I don’t blame them. Affordability is at an all time low. However, with rates rallying and the FED seemingly done increasing rates we could see lots of action in the first quarter of 2024, especially if rates are in the 6’s and buyers have the opportunity to ‘buy’ down their rate into the 5’s! This changes the ballgame. You have to ask yourself, which sellers does this potentially bring off the sidelines?? Only time will tell, but if trend continues I expect early 2024 to get going sooner than the traditional spring/summer selling season. I have to say, personally, I’m all for it. We need to see positive movement in the market place. We need to see transactions, ideally fair and prosperous for both buyers and sellers. 2024 could be a great year for everyone in the real estate marketplace!

Market Segments - December 2023

“With rates reaching a 23-year high in late October, the share of consumers who said that it would be a good time to buy reached a new survey low at 15%.”

Market Profile - December 2023

HOT TOPICS

Would you like a free home report every month? If you’d like a free home report every month, all I need is your home address and a good email for you. I’ve been getting great feedback from everyone who is getting them. It’s a great way to track home values, loan information, payoff ideas, and what you might be able to rent your home for. Send me an email to brendan@vshometeam.com to be added!

Mortgage rates hit a four-month low - Interest rates drop for the sixth consecutive week due to softer economic data signaling a slow-down in inflation. Last week, Freddie Mac reported a 19 basis point decrease in the average 30-year fixed rate mortgage, totaling a 76 bps drop since its late October peak. The job market seems to be stabilizing, showing signs of softening, but remaining steady. This week might see rate fluctuations following Tuesday's November Consumer Price Index (CPI) release and the Fed's announcement on their next rate hike, scheduled for Wednesday.

Homeowner equity made a comeback in Q3 - Homeowner equity increases after a slight dip earlier in the year, per CoreLogic. In the U.S., homeowners with mortgages saw a $1.1 trillion increase in equity since Q3 2022, a 6.8% yearly jump. Properties with negative equity dropped by 7.7% from Q2 and 8% from Q3. Only about 2% (1.1 million) of mortgaged properties were underwater, way lower than the 26% peak in Q4 2009. On average, U.S. homeowners gained $20,000 in equity last quarter compared to a year ago. California ranked second in equity gain, with an average increase of $51,000 in Q3 2023. The state had the smallest share of homes with negative equity at 0.6%.

November's job report was better than expected - November’s job report showed 199k jobs added, thanks in part to the resolution of strikes in entertainment and auto industries. Unemployment dropped to 3.7% from October's 3.9%, with more people entering the job market. However, the job market seems to be cooling despite these numbers. Retailers saw their smallest yearly hiring increase in three years in October, continuing in November with a decline of 38k jobs. While the 3-month average of nonfarm payroll remained solid at 204k between September and November, it's notably slower than last year's 300k plus average at the same time.

Consumer sentiment surged in early December - Consumer sentiment jumped 8.1 points to 69.4 from November's 61.3, the biggest increase since March 2021 and beating expectations. This boost came largely from improved inflation expectations, with the one-year outlook dropping from 4.5% to 3.1%, the largest one-month dip in 22 years. With inflation easing and interest rates at a four-month low, consumers' views on the future economic outlook also improved. The index for consumer expectations shot up from 56.8 to 66.4 in December, potentially impacting holiday spending positively for the year's final stretch.

With only 19 days until 2024 I have started to solidify my goals for next year, have you? Is buying or selling your home something that’s on your mind? If so, let’s talk about when is the best time to buy or sell. I hope you have a Merry Christmas and a prosperous New Year!

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I always appreciate referrals! It’s among the greatest compliments I can receive. If you know someone who is has questions about the real estate market, please send them my way. Thank you!