Market Update - September 2023

Market Action Index - September 2023

Well…. we hit a new high in interest rates (over 7%) since June of 2001. Just before 9/11 for those tracking history. The market has slowed considerably, with the last two months being some of the worst sales months in the last 40 years. ”Low inventory made for a sluggish purchasing month with 2,435 sales, which is the second-lowest sales month for July in records dating to 1988.”

I do have a listing coming on the market at the end of the month, but that’s because the owners are moving into assisted living. They aren’t going to buy back into the market after selling. These situations along with anyone leaving the state are really the only listings that are going up right now. One thing that could change is if the labor market continues to soften and we have more distressed sellers entering the market. Not because they want to, but because they have to… more on labor market and mortgage delinquency rates (historically low) in the hot topics below.

Homes prices are at all time historical highs. This means if you have the cash, can afford the current rates, and/or want to move out of state or just sell and get out of the real estate game, NOW is as good as a time as ever. It’s hard to predict how long this will go on.

Market Profile - September 2023

However, if rates start to drop, prices are going to continue to go up UNTIL whatever that magical interest rate is where the current 2-3 percenters would consider selling. There will be a breaking point with the dam that’s holding all the inventory back. That is, if we ever get THAT low. My guess is that we really would have to be back in the low 5’s or high 4’s to get most sellers to consider listing.

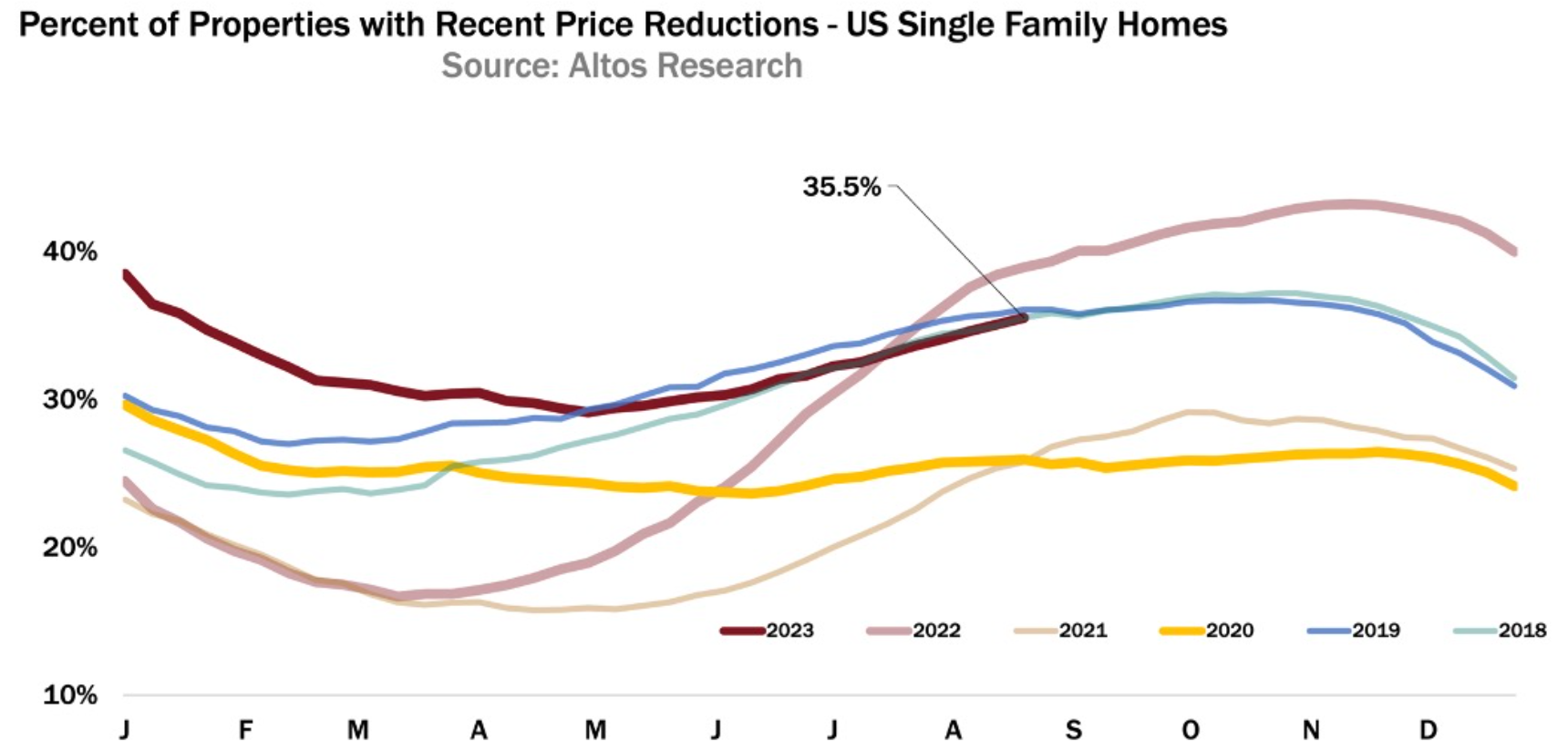

Days on the market is staying pretty level and there is a LITTLE more inventory, but let’s not kid ourselves. There’s not much out there. One thing to keep an eye on is days on market AND how many price reductions are being done. This would indicate that more buyers have taken to the sideline and are so frustrated they’re taking their ball and going home. I don’t blame them.

“Low inventory made for a sluggish purchasing month with 2,435 sales, which is the second-lowest sales month for July in records dating to 1988.”

September 2023 - Price Reductions trending up…

HOT TOPICS

Cooling labor market - In August, U.S. employers added 187,000 jobs. However, the job growth has slowed for three consecutive months, averaging 150,000 per month. The unemployment rate rose to 3.8% due to factors like the Yellow trucking firm shutdown and entertainment industry strikes. Looking ahead, there's less optimism for hiring and expansion, with only 38% of respondents in the third-quarter. Chief Human Resources Officer Confidence Index is expected to increase hiring in the next six months, down from 51% in the previous quarter.

Mortgage rates dip for the first time in six weeks - After rising for five straight weeks, the average 30-year fixed-rate mortgage, as reported by Freddie Mac, dipped at the end of August but stayed above 7%. This drop could be linked to concerns about a cooling job market, slowing consumer spending, and a downward revision of second-quarter GDP.

While it's expected that the Fed will keep their policy rate steady in the upcoming September meeting, mortgage rates are still high, and the market may remain volatile until the Fed provides a clearer signal on its next move. With borrowing costs near record highs and a tight housing supply expected for the rest of the year, home sales might stay sluggish in the coming months.

Consumer confidence slips - In August, consumer confidence took a hit due to a slower job market and rising food and energy prices. The U.S. Consumer Confidence Index, released by the Conference Board, dropped to 106.1, falling short of the expected 116.0. Factors like fewer job opportunities, higher interest rates, and a less positive stock market performance in August contributed to this decline. The upcoming resumption of student loan payments in October, affecting over 43 million borrowers, might also dampen consumer spending on goods and services, although the overall economic impact is expected to be relatively minor.

Delinquency rate remains near all-time low - In June 2023, the U.S. mortgage delinquency rate dropped to 2.6%, down from 2.9% in June 2022 and remained unchanged from May 2023. This rate is close to its all-time low and much lower than the peak during the 2009/2010 housing market crash. The national foreclosure rate also stayed low at 0.3% in June 2023, the same as in June 2022. In California, the foreclosure rate was just 0.024%, or one in every 4,188 households, according to ATTOM Data's July 2023 report. This is a significant improvement from the double-digit rates seen during the Great Recession. The counties with the highest foreclosure rates in California were Yuba, Shasta, Sierra, and Tulare.

One last note I will remind you is that we have a long list of trusted contractors and resources for any and all things related to your home. If you need a contract person, please let me know!

I’m in no rush but certainly feels like we’re sprinting towards the holidays… what happened to this year??! I'm here for anything you need. Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I live on referrals (and will love you forever) if you send someone my way. It’s among the greatest compliments I can receive. I will treat them like family. Thank you in advance!

Brendan