Market Update - October 2023

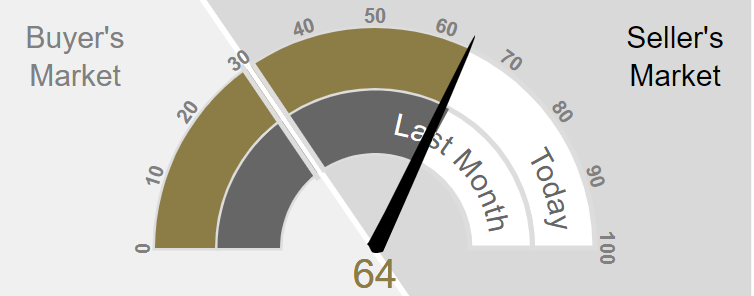

Market Action Index - October 2023

Since I have hosted a couple open houses in the last month, I have had the unique experience of chatting with over 40 groups of potential buyers. What I’m noticing is that home buying demand is there, but the affordability is debilitating. I’m not sure how many of those 40 were serious buyers, but my guess is about 25%. My qualitative, unofficial take is that the home has to be darn near perfect for buyers in order for them to make an offer. And I don’t mean the home is perfect (none are), but that it’s perfect FOR them.

Interest rates continue to push higher and even touched 8% for a period over the last week. The FED seems content to hold, and I’m not sure that will change given the economic data regarding jobs and consumer spending. See more these topics in the hot topics section below.

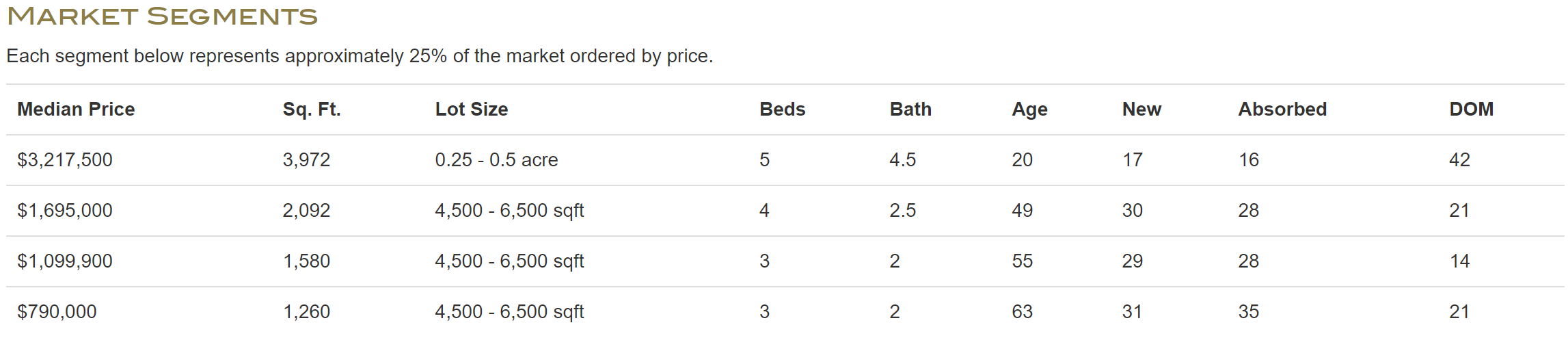

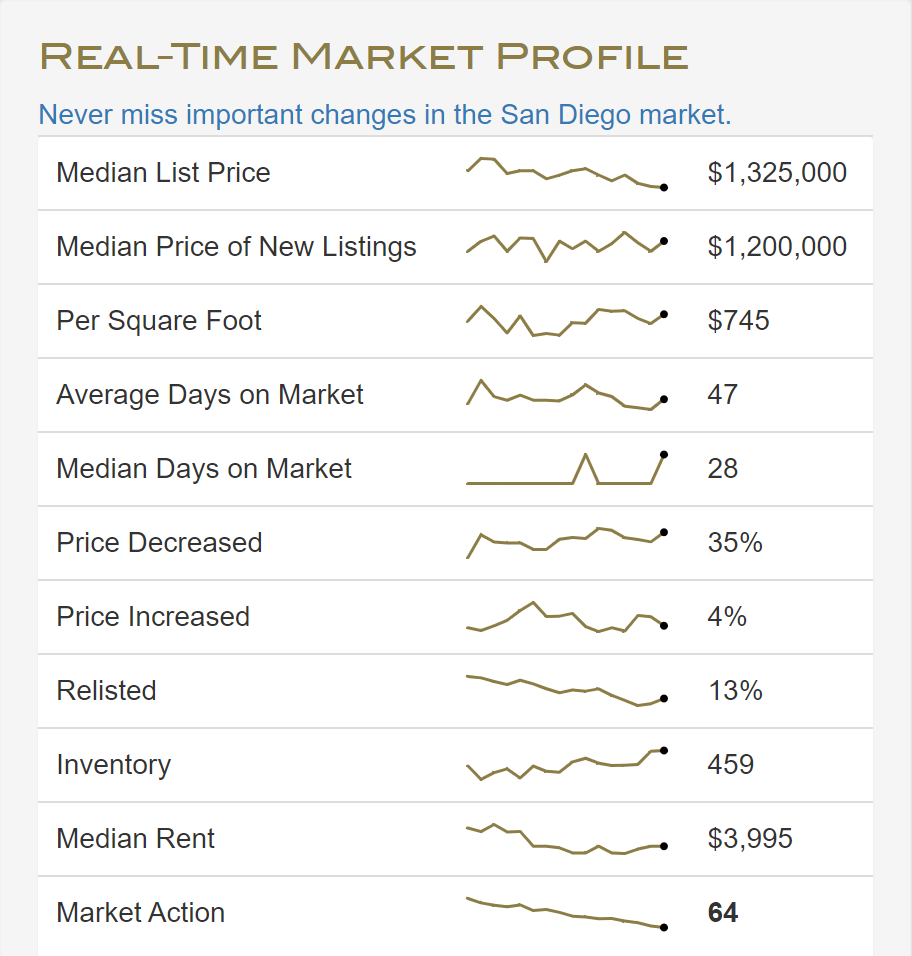

Market Profile - October 2023

HOT TOPICS

Owning a home still rocks - The Federal Reserve's 2022 Survey of Consumer Finance just dropped. It revealed that most of the moolah in the U.S. is made by homeowners. Last year, the average U.S. household's worth hit $192,900 (adjusted for inflation). But get this: homeowners' median net worth was a cool $396,200. Renters, on the other hand, were lagging way behind at just $10,400. That's barely $1,000 more than the peak back in '95. Bottom line? Renting just doesn't cut it for building wealth. So, having your own place is the smart money move for the long haul.

Consumers aren't bothered by rates or debt - Credit card debt has shot up by almost $150 billion since before the pandemic, but folks are still spending. In September, retail sales kept climbing, especially in the services sector. Some credit card debts are turning sour, but people are still hitting bars, hotels, and restaurants hard. Even after factoring in high inflation, real retail sales are more than 10% above pre-pandemic levels from January 2020. With consumers making up nearly 70% of the U.S. economy, this could mean a stronger Q3 economic growth than expected. So, don't expect any rate cuts from the Federal Reserve until next year.

Rates keep going up as the bond market embraces "Higher for longer." - The average 30-year fixed mortgage rate hit over 8% twice in the past week. This is because the bond market is okay with the Federal Reserve's plan to keep rates high for longer than expected. The 10-year Treasury rate is getting close to 5%, despite the Fed Chairman saying they won't raise rates this year. People are also flocking to safe U.S. Treasuries due to Middle East tensions and oil supply concerns. While this makes the yield curve, which predicts recessions, less inverted, it means we're stuck with higher mortgage rates likely until the end of the year.

California's housing scene takes a hit as rates climb - Housing stock in California remains super tight, even compared to recent years. But here's the scoop – the recent rate hikes are starting to put a dent in the homebuyer frenzy. Home sales dropped to around 240,000 units last month, a tad above the low point in November 2022 when they hit 235,000 units. It's clear that getting back to "normal" levels of transactions will be a bumpy ride. Home prices are still inching up, despite a small dip from August due to the season. The median price of an existing single-family home in California has gone up for the third month in a row compared to last year.

Job market stays strong, but unemployment goes up - In September, California saw around 9,000 new jobs added. Industries like tourism, bars/restaurants, entertainment, and healthcare were up, but manufacturing, tech, and professional jobs took a hit. Sadly, the unemployment rate bumped up to 4.7%, with over 900,000 folks jobless for the first time in a year and a half. This uptick in unemployment hints that the job market might not be as robust as it seems. And data from the state's unemployment insurance payments, albeit a bit outdated, supports the idea that things might be weaker than the headlines suggest.

I don’t know about you, but I’m ready for a little break. I’m looking forward to Thanksgiving and spending some quality time with my little family. Hope you are able to find some time to relax too!

Reach out anytime! Call, text, or message me 😊

Brendan

P.S. I live on referrals (and will love you forever) if you send someone my way. It’s among the greatest compliments I can receive. I will treat them like family. Thank you in advance!

Brendan